PhonePe is a payment gateway used for conducting various financial transactions. It also offers various facilities like UPI, investments, recharges, insurance to all its app users. It is a widely known and popular fin-tech company in the country. Plus, in this digital age, many people prefer using online payment methods. Hence PhonePe has been adopted by many online businesses as a payment method. However, to offer PhonePe as a payment option, a fee is supposed to be paid to PhonePe on each order payment processed. Since there are multiple payments processed on a daily, it can be quite hectic for businesses to keep track of the fee and tax charged on each order. Numerous times, the fee or tax is overcharged and this happening consecutively over a period of time can lead to losses. Hence PhonePe Payment Gateway Charges Verification is an important process that needs considerable attention.

Now, with our automated reconciliation software this process can be done easily at the click of a button. The fee, tax and the final settlement amount is first calculated by the software and then compared with the PhonePe Report. Then its shows exactly on which orders the amount is overcharged, undercharged or correctly charged. This way finance teams can know the exact amounts to be paid and avoid paying extra unnecessarily.

Reports Used for PhonePe Payment Gateway Charges Verification

PhonePe Payment Report

The transaction amount and date, fee and tax applicable, mode of payment and issuing bank of each and every order is recorded in this report

PhonePe Rate Card

The fee and tax applicable and the dates between which these rates are applicable are recorded in this report.

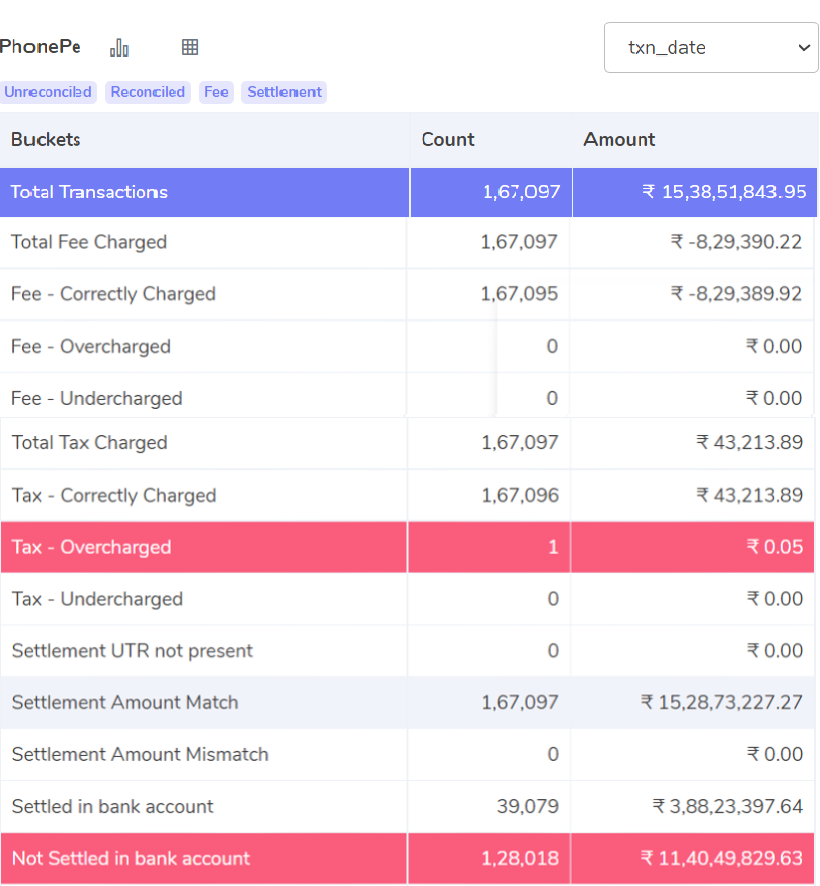

PhonePe Payment Gateway Charges Verification Result

Fee – Correctly Charged

These are the orders on which the fee charged by PhonePe matches the calculated fee amount by the software. So, it means that fee is correctly charged on these orders

Fee – Overcharged

These are the orders on which the fee charged by PhonePe exceeds the fee amount calculated. So, it means that the fee was overcharged on these orders.

Fee – Undercharged

On these orders the fee charged by PhonePe was lesser than the calculated fee amount. So, it means that fee was undercharged on these orders

Tax – Correctly Charged

When the tax charged by PhonePe matches with tax amount calculated by the software, it means that tax charged by PhonePe is correct. Those transactions are displayed here. The tax is estimated a as per 18% GST on fee.

Tax – Overcharged

On these orders the tax charged by PhonePe is more than the tax amount calculated by the software. The tax is estimated as per 18% of GST on fee.

Tax – Undercharged

On these orders the tax charged by PhonePe is lesser than the tax amount calculated by the software. This means that tax is undercharged on these orders. Tax calculation is as 18% of GST on fee.

Settlement Amount Match

Settlement Amount = Amount Collected from Customer – Fee Charge – Tax Charge

The settlement amount is calculated using the above formula. After which the software displays the orders for which the settlement amount in the PhonePe report matches with the calculated settlement amount.

Settlement Amount Mismatch

The settlement amount is calculated using the same formula as mentioned above. After which the software shows the orders for which the settlement amount in the PhonePe report does not match with the calculated settlement. So that means that settlement amount paid by PhonePe is wrong on these orders.

Settlement UTR not present

The software checks with the PhonePe report and shows here the transactions for which the settlement UTR is not to be found in the PhonePe report. Since the UTR is not present these orders cannot be transacted to the bank account

Settled in Bank Account

When the transaction is present in both the PhonePe report and the bank statement, it means that these transactions are settled in bank and that company has received the amount owed from PhonePe.

Not Settled in Bank Account

When the transaction is present in the PhonePe report but not in the bank statement, it means that PhonePe has to still make the payments to the company’s bank account.

Tables and graphs are used to present the result above in an easy-to-understand way. It makes it simpler for company finance departments to analyze the result. The software also informs you if any fees or taxes have been overcharged, which can help you save future losses. It also demonstrates if the settlement sum is accurate and whether the total sum has actually been sent to your bank account. This will enable you to keep track of each payment made and, in the event of a loss payment, you can obtain the proper amount from the bank or PhonePe.