Understanding Flipkart’s commission fee structure is crucial for any seller’s success on the platform. This guide provides a comprehensive overview of Flipkart’s commission fees, empowering you to make informed pricing decisions and maximize your profits.

What are Flipkart Commission Fees?

Flipkart charges sellers a commission fee for using their marketplace services. This fee is a percentage of the Order Item Value, which includes:

Selling Price:

The price at which you list your product.

Shipping Charges:

Any shipping costs associated with the order.

What’s Excluded from Commission Fee Calculation?

Seller Discounts:

Any discounts you offer to customers are not included in the commission fee calculation.

Non-Delivery/Same-Day Delivery Charges:

These additional delivery service charges are not factored into the commission fee.

Flipkart Commission Fee Refunds

In the event of an order refund, Flipkart reimburses the commission fee you were charged.

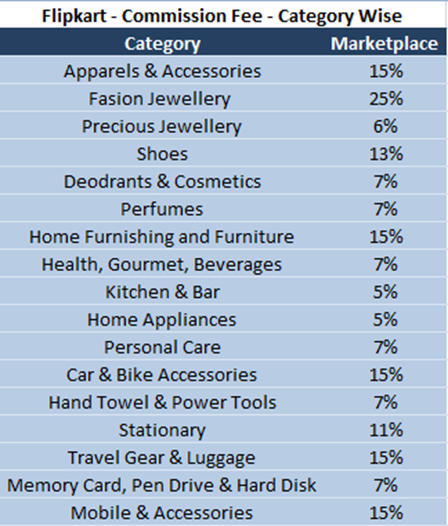

Commission Rate Variations

Sub-Category Based:

Flipkart’s commission rates vary depending on the sub-category your product falls under.

FSN (Flipkart Serial Number):

In some cases, the commission rate might also differ based on the product’s FSN (Flipkart Serial Number).

No Commission on Returns

Flipkart does not charge commission fees for orders returned by customers or due to courier issues.

Universal Rate Card & Commission Rate Range

All seller tiers on Flipkart are subject to the same commission rate card. The commission rates can range anywhere from 2.8% to 25%.

Finding Your Exact Commission Rate:

While this guide provides a general range, to determine the exact commission rate applicable to your specific products, you can follow these steps:

- Login to your Flipkart seller account.

- Navigate to Payments > Payments Overview.

- Locate Flipkart Rate Card on the right side of the screen.

- Select your business model and product category.

- Click on Get rate card to view the commission rate for your products.

Managing commission fees on Flipkart can be a daunting task, especially for sellers juggling a vast product variety. Verifying these fees against Flipkart’s charges often takes immense time and effort. This is where Cointab steps in, offering a revolutionary solution for effortless commission fee verification.

Cointab: Your Flipkart Fee Verification Partner

Cointab simplifies commission fee verification for high-volume Flipkart sellers.

Here’s how:

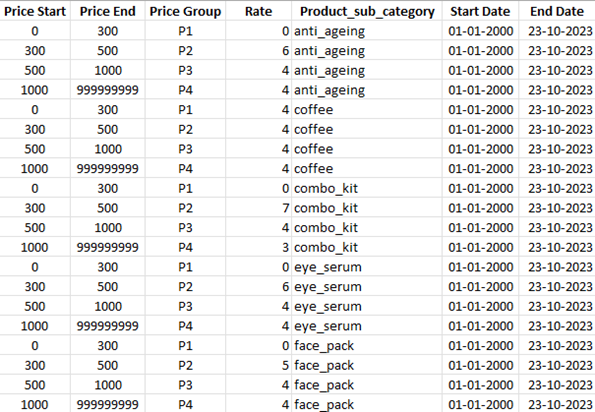

Automated Rate Card:

Cointab eliminates the need to manually track Flipkart’s complex fee structure. It boasts a comprehensive, built-in rate card containing all relevant charges and commission percentages. This ensures you have instant access to accurate fee information for any product category.

Effortless Verification:

Gone are the days of manual calculations and time-consuming comparisons. Cointab automates the verification process. Simply input your product details, and Cointab calculates the exact commission fee you should be charged. This allows you to quickly compare it with Flipkart’s charges and identify any discrepancies.

An example of the rate card by the system

Unveiling Flipkart Fees: A Seller’s Guide to Streamlined Reconciliation

Managing commission fees on Flipkart is essential for any seller’s success. This guide introduces a streamlined approach to commission fee reconciliation, empowering you to effortlessly track and analyze your profits.

The Power of Side-by-Side Data Presentation:

Flipkart’s reconciliation system automatically fetches your order data and calculates crucial metrics for each order. These metrics are then presented in a clear, side-by-side format. This visual presentation offers several benefits for sellers:

Enhanced Readability:

By displaying all relevant data points side-by-side, the system simplifies information access and comprehension. You can easily grasp crucial details about each order’s commission fee without the need for complex calculations or data manipulation.

Effortless Comparison:

The side-by-side format allows for effortless comparison of commission fees across different orders. This empowers you to identify trends, outliers, and potential discrepancies with minimal effort.

Benefits of Streamlined Reconciliation:

Save Time:

The automated data presentation and side-by-side format significantly reduce the time required for commission fee reconciliation. This frees up valuable time you can dedicate to other aspects of your business.

Improved Accuracy:

The system’s automated calculations minimize the risk of errors associated with manual calculations. This ensures greater accuracy in your financial records and profit tracking.

Empowered Decision-Making:

Streamlined reconciliation grants you clear insights into your commission fees. This knowledge empowers you to make informed decisions regarding pricing strategies, product selection, and future negotiations with Flipkart.

Mastering Flipkart Fees: A Seller’s Guide to Commission Clarity

Understanding your commission fees on Flipkart is crucial for maximizing profits. This guide utilizes an image (replace with “screenshot” or “graphic” for better SEO) to visually explain how each order’s commission fee is presented.

Key Data Points in the Flipkart Commission Fee Breakdown:

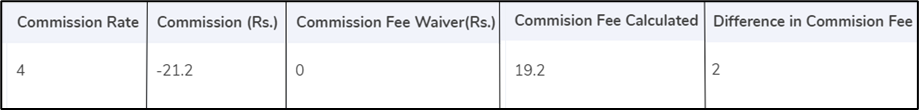

Rate of Commission:

This represents the commission percentage calculated by the system based on the item details you provide.

Search for: “Flipkart commission rate structure”

Commission:

This highlights the commission amount Flipkart charged you, as reflected in your order report.

Commission Fee Calculated:

This showcases the accurate commission fee the system calculates based on the item details and the applied commission rate.

Difference in Commission Fee:

This crucial metric reveals any discrepancies between the commission Flipkart charged and the calculated amount. It further clarifies if you were overcharged or undercharged and by what amount.

Benefits of Understanding Commission Fee Breakdown:

Identify Potential Overcharges:

By analyzing the difference in commission fee, you can promptly identify instances where Flipkart might have overcharged you. This empowers you to recover any discrepancies and safeguard your profits.

Ensure Accurate Refunds:

In cases of order cancellations, Flipkart reimburses a portion of the commission fee. This breakdown ensures you receive the correct refund amount based on the calculated commission, not a potentially lower figure.

Gain Transparency and Control:

A clear understanding of commission fee components fosters transparency and empowers you to make informed decisions. You can potentially adjust your pricing strategies or negotiate with Flipkart for better commission rates in the future.

Managing Marketplace Fees: A Seller’s Challenge

Running a successful online business on marketplaces like Flipkart requires meticulous attention to detail. One crucial aspect is staying informed and in control of various fees, especially commission charges. These fees directly impact your profit margins, so ensuring accurate calculations is essential.

This comprehensive guide empowers Flipkart sellers with the knowledge to reconcile their commission fees effectively. By understanding key metrics and following a streamlined process, you can identify discrepancies, recover potential overcharges, and ultimately maximize your profits.

Key Metrics Explained:

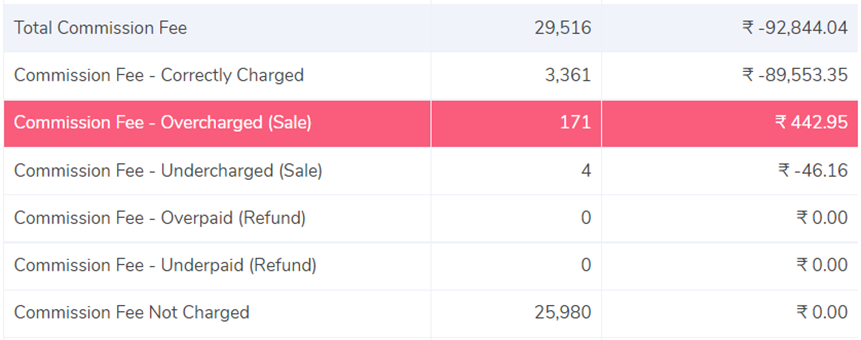

Total Commission Fee:

This represents the total amount Flipkart charges you as a commission on your sales. It’s vital to track this metric to understand the overall impact of commission fees on your business.

Commission Fee – Correctly Charged:

This metric highlights orders where the commission fee levied by Flipkart matches the amount calculated by a trusted tool like Cointab. Cointab helps sellers estimate their commission fees accurately before listing products. Having a high percentage of “Correctly Charged” fees indicates a smooth reconciliation process.

Commission Fee Discrepancies:

Overcharged (Sale):

This metric identifies instances where Flipkart has charged you more than the calculated commission on a sale. It’s crucial to address these discrepancies promptly to recover any overcharged amounts.

Undercharged (Sale):

While less common, this metric flags situations where Flipkart might have undercharged you in commission on a sale. While it may seem beneficial at first glance, it can lead to future adjustments or account discrepancies.

Commission Fee Refunds:

Overpaid (Refund):

This metric signifies situations where Flipkart has refunded you more than the calculated commission amount for canceled orders. While rare, it’s recommended to double-check such instances to ensure there are no errors.

Underpaid (Refund):

This metric is more concerning, highlighting instances where Flipkart has refunded you less than the calculated commission amount for canceled orders. Following up on these discrepancies is crucial to ensure you receive the full amount owed.

Commission Fee Not Charged:

This metric tracks the number of orders where Flipkart didn’t charge any commission fee. While there might be legitimate reasons for this (promotional offers, specific product categories), it’s essential to understand these exceptions to avoid any confusion in your accounting.

Benefits of Regular Commission Fee Reconciliation:

Identify and Recover Overcharges:

Proactive reconciliation helps you identify instances where Flipkart has overcharged you in commission fees. By promptly addressing these discrepancies, you can recover the overcharged amounts and improve your profit margins.

Ensure Proper Commission Refunds:

When orders get canceled, Flipkart reimburses a portion of the commission fee. Reconciliation ensures you receive the accurate amount owed based on the calculated commission and not a potentially lower figure.

Gain Valuable Insights:

Regular reconciliation helps you identify trends in commission fee discrepancies. This knowledge empowers you to develop better pricing strategies and potentially negotiate more favorable commission rates with Flipkart in the future.

Taking Action for Accurate Commission Fees:

Schedule Regular Reconciliation:

Make commission fee reconciliation a regular part of your accounting process. The frequency can vary depending on your sales volume, but a monthly or bi-monthly review is recommended.

Leverage Calculation Tools:

Utilize trusted tools like Cointab to estimate your commission fees before listing products. This proactive approach helps identify potential discrepancies early on.

Compare and Analyze:

Meticulously compare the calculated fees from Cointab (or similar tools) with the commission amounts reflected in your Flipkart seller reports.

Address Discrepancies Promptly:

If you identify any discrepancies, don’t hesitate to contact Flipkart seller support for clarification and resolution. Maintain clear documentation of your communications and calculations to ensure a smooth resolution process.

By following these steps and making commission fee reconciliation a regular practice, you can ensure accurate charges, maximize your profits, and gain valuable insights to optimize your pricing strategies on Flipkart. Remember, a proactive approach to commission fee management is essential for the long-term success of your Flipkart business.

Get started with Cointab!

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation