DHL is a globally operating company originating from Germany, it provides various shipping and logistics to companies and customers. Its shipping services range through various modes of transport like road, air, rail and water freight. DHL‘s logistics services are very well-known by numerous companies as they provide warehousing, supply chain solutions and transportation solutions. Along with all these major services to enable customer satisfaction DHL also facilitates package tracking. Due to all these facilities, many companies partner with DHL as a courier partner.

To partner with DHL, a fee is supposed to be paid on each order delivered. The fee calculation depends on the location of the delivery, the weight of the product delivered and the rate percentage charged by DHL. As so many factors are important to calculate the fee, sometimes a factor value might be wrongly given and hence you might end up overpaying the fee. Another reason for overcharging might be that the amount calculated by DHL is just incorrect. When this happens, you pay more than the expected fee and hence incur a loss over time.

To avoid overpaying and the extra effort needed for verification you can automate the DHL Courier Charges Invoice verification process by using our software. Our software saves the time and human effort needed to conduct reconciliation and in turn, also provides an accurate reconciliation result that is ready to analyze. The software calculates the fee amount by checking the location, weight and rate applied and also shows on which orders an incorrect amount is paid.

Required Reports for DHL Courier Charges Invoice Verification

Pin Zone Report

The delivery location’s Pincode for every order delivered is recorded in this report.

SKU Report

It serves as a record of the weight and the dimensions of each product delivered.

Rate Card

The rates applicable provided by DHL and the period it is valid for are present in this report

DHL Invoice

The invoice consists of the weight, zone and rate applied for billing and the final amounts charged.

DHL Courier Charges Invoice Verification Process

The software checks the fee amount by first verifying the delivery location, product weight and the rate charged. The software determines the estimated values for each of these factors and so that it can further calculate the expected fee to be charged by DHL.

Weight

- The gross weight is considered to represent the volumetric weight in the absence of dimensions.

- The volumetric weight is determined using the “Length x Width x Height” calculation when dimensions are given.

- The final weight is then calculated by dividing the volumetric weight by a divisor.

- To obtain the anticipated weight, we compare the volumetric weight and the gross weight, then take into account the higher of the two.

- After which the sum is rounded up to form the final slab.

Pincode Zone Location

- The software generates the anticipated zones based on the pin codes that are contained in the Pincode Master report.

- This is mainly checked so that software can carry out further fee calculation

Rate Card

• The rate card includes the rates and associated charges for the specified orders.

• In addition, the software uses the start and end dates to check the duration for which charges are payable.

Charges

Expected Forward Charge

The rate labeled “fwd fixed” is used when the resulting slab weighs less than or equal to the weight limitation “fwd wt fixed.” The rate will be determined using the “fwd” column if the weight exceeds the value supplied. Lastly, the formula used to get the expected forward charge is as follows.

Expected_fwd_chg = fwd_fixed + (extra_weight) x fwd

Expected RTO charges

The rate named “rto fixed” is applied when the final slab weighs less than or equal to the weight limitation “rto wt fixed.” The rate will be determined using the “rto” column if the weight exceeds the value supplied. Last but not least, the methodology used to determine the expected RTO fee is shown below.

Expected RTO charge = fixed_rto_chg + (extra_weight_slab) x add_rto_chg

Expected COD charges

The greater number is used as the anticipated COD fee after comparing the “cod fixed” and “cod rate”% on the item price values.

Expected GST

The GST is applied to the final sum after the anticipated forward charge, anticipated RTO fee, and anticipated COD charge has been summed up.

Expected Final Amount

The forward charge, expected RTO fee, expected COD charges, and expected GST are added to determine the anticipated final sum.

DHL Courier Charges Invoice Verification Result

The software does the appropriate calculations for each order after checking the predicted zone, rate, weight, and estimated charges. After which it shows if the anticipated zone, rate, and weight are used for billing and whether the amount charged is more or lesser than what is supposed to be charged.

Found in Shopify

The Shopify report is used for verification since it keeps tabs on the weight of delivered goods and makes the relevant data available. This enables comparing the product’s weight to the weight DHL uses for billing simpler. This row shows the orders that were included in both the DHL report and the Shopify report.

Not Found in Shopify

The orders that are shown in this row are not present in the Shopify report but they are present in the DHL report. This indicates that there is no data available on the weight of these orders. The weight of these orders cannot thus be verified.

Found in Zone Master

The orders shown are found in the Pincode master report which means that these orders can be verified by the software.

Not Found in Pincode Master

These orders are not present in the Pincode master report, hence the software cannot calculate the fee amount for these orders.

Found in Rate Card

The orders that are listed on the rate card are shown here. The rates that will be used for order delivery may then be verified.

Not Found in Rate Card

The rate card in this case does not contain the orders. The charges for these orders cannot thus be verified.

SKU Found

These orders can be detected in the SKU report, so the software can estimate their expected weight.

SKU Missing

The software cannot determine the estimated weight of these orders since they are not included in the SKU report.

Invoice Verification using OMS – DHL

Here, the software calculates the billing amount using the anticipated zone, weight, and rate. After which it compares the DHL Invoice with the calculated amount. Since DHL does not provide zone applied for billing, we only use the zone we have assumed as mentioned in the Pincode master report. After all this, the software shows if any amount is overpaid or underpaid.

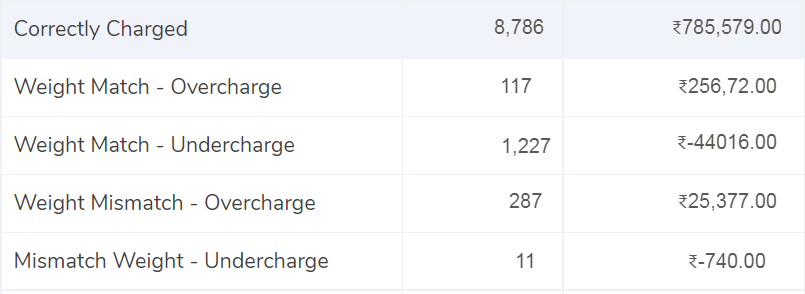

Correctly Charged

On these orders, it is seen that the weight and rate applied are correct and the final amount mentioned in the invoice matches with the calculated amount.

Weight Match – Overcharge

It is determined that the weight used for billing is correct. However, the rate used is incorrect. As a result, the amount charged is more than the calculated amount.

Weight Match – Undercharge

The weight applied for billing on these orders is determined to be accurate. However, the rate used is incorrect. As a result, the amount charged is less than what was calculated.

Weight Mismatch – Overcharge

It is established that the weight used for invoicing on these orders is incorrect. But the rate being utilized is appropriate. Due to this, the amount charged is more than what was anticipated.

Mismatch Weight – Undercharge

The appropriate rate is applied to the orders shown here. Yet the weight is incorrect. This ultimately results in charging less than what was necessary.

Using the output presented by our software finance teams can now easily track the fee charged on every order and claim the amount that they have overpaid. It streamlines the work of the finance department by automating the DHL invoice verification process. Additionally, businesses can be guaranteed that the amounts charged in the invoice are verified without any additional work on their part.