Amazon Pay is a payment services provider application owned by one of the largest companies in the world i.e. Amazon. It provides all the payment-related functions like money transfer, bill payment, recharge, loan payment and insurance etc. This facilitates all these payment services but it started with the intention of giving amazon account users the opportunity of making bill payments easier for them on any shopping site. Since many people are Amazon users, a large number of other online businesses find it necessary to offer AmazonPay as a payment option. Thus, many businesses partner with Amazon Pay as a payment gateway partner.

However, Amazon Pay requires a fixed fee and tax to be paid on each payment in order to access its services. It could be exceedingly challenging for businesses to track the fees and taxes incurred for each order. And also keep track of the final amount settled in the bank. So, to verify these payments, our automated reconciliation is very helpful. Our software verifies the amounts charged and then shows how much is overcharged or uncharged or if the amount paid is wrong. This in turn will help you avoid the unnecessary extra fee or tax payments.

Reports Used for Amazon Pay Payment Gateway Charges Verification

Amazon Pay Payment Report

This report includes the transaction amount, date, fee and tax %, payment method, and issuing bank.

Amazon Pay Rate Card

The AmazonPay rate card includes the fee and tax % as well as its validity dates.

Amazon Payment Gateway Charges Verification Result

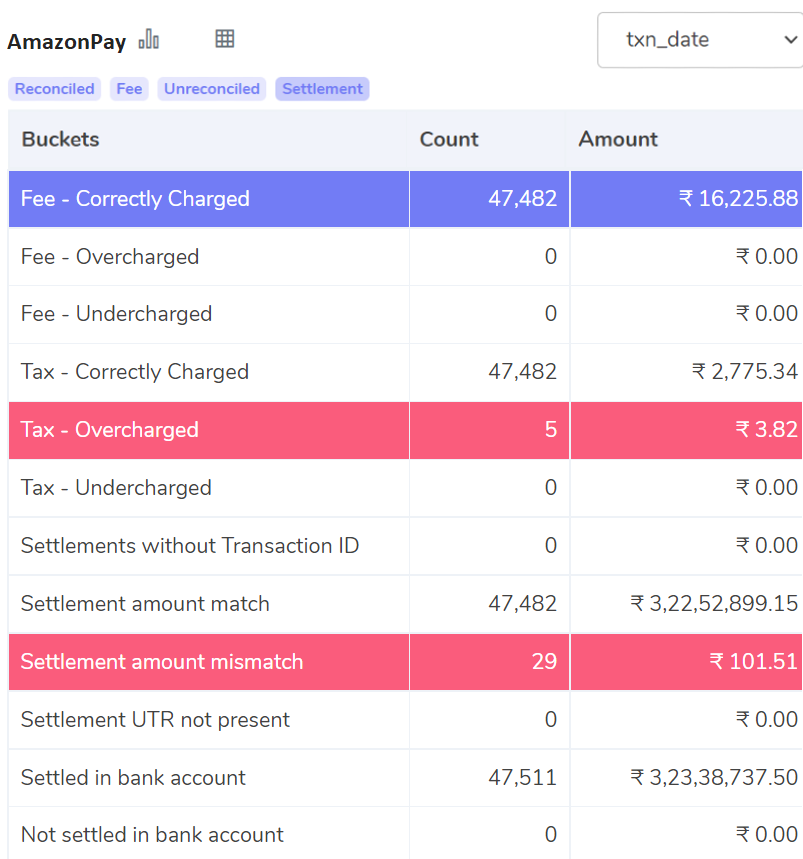

Fee – Correctly Charged

For these orders, the fee amount charged by Amazon Pay is equal to the fee amount calculated. That means the amount recorded in the Amazon Pay report is the same as the calculated amount.

Fee – Overcharged

On these orders, the fee charged by Amazon Pay does not match the fee amount calculated by the software. It shows that on these orders, the fee is more than the expected amount. Hence fee is overcharged on these orders.

Fee – Undercharged

For these orders, the fee charged by Amazon Pay does not match the fee amount calculated by the software. It shows that on these orders, the fee is lesser than the expected amount. Hence fee is undercharged on these orders.

Tax – Correctly Charged

Our software shows the orders for which Amazon Pay’s tax charge is correct in terms of the contract. It means that the tax amount recorded in the Amazon Pay report is equal to the calculated tax amount. The 18% GST portion of the fee is used to calculate the tax.

Tax – Overcharged

These are the orders on which the tax amount recorded in the Amazon Pay report does not match the calculated tax amount. Here, the tax amount charged by Amazon Pay is more than the tax amount calculated. The 18% GST portion of the fee is used to calculate the tax.

Tax – Undercharged

For these orders, on which the tax amount recorded in the Amazon Pay report does not match the calculated tax amount. Here, the tax amount charged by Amazon Pay is lesser than the tax amount calculated. 18% GST of the fee is used to calculate the tax.

Settlement Amount Match

Settlement Amount = Amount Collected from Customer – Fee Charge – Tax Charge

The software calculates the settlement amount using the above formula and verifies the same with the Amazon Pay report. It shows in this bucket the orders, on which the settlement amount calculated match with the settlement amount recorded in the AmazonPay report.

Settlement Amount Mismatch

The settlement amount is calculated using the above formula. After which the software verifies the same with the Amazon Pay report. It shows in this bucket the orders, on which the settlement amount calculated does not match with the settlement amount recorded in the Amazon Pay report.

Settlement UTR not present

The transaction ID for payments made to the bank is called UTR. However, if the UTR for settlements cannot be located, it indicates that no orders were ever placed at all. These orders are shown by the software in this bucket.

Settled in Bank Account

Our software compares the final settlement amount shown in the Amazon Pay report with the amount recorded in the bank statement. Then it presents the orders for which the the amount is same in both reports. This indicates that Amazon Pay settles these order payments in your bank account.

Not Settled in Bank Account

As mentioned above, the software verifies the settled amount with the Amazon Pay report and the Bank statement. It shows the orders for which the amount to be settled in the bank is not found in the bank statement. It means that Amazon Pay has not yet settled these transactions in your bank account.

The final output, which displays the reconciliation result, is seen above. Finance teams can quickly keep track of the fees, taxes, and amounts settled in the bank largely due to the software’s easy-to-understand results. Additionally, the software displays the overcharged or undercharged amount, assisting you in preventing extra unnecessary payments.

So, if you want to automate your Amazon Pay Charges Verification Process, then try our automated reconciliation software.