Maximizing Efficiency and Accuracy in Authorize.net Payment Processing with Automated Reconciliation Solutions:

In the realm of online transactions, Authorize.net stands out as a premier payment gateway, facilitating secure and convenient financial services for businesses and consumers worldwide. Leveraging its platform, consumers can seamlessly execute payments using various trusted channels, including debit cards, credit cards, and QR codes. For businesses seeking to provide their customers with a reliable payment experience, partnering with Authorize.net emerges as a strategic choice.

The Importance of Accurate Fee Management:

While the benefits of using Authorize.net are evident, businesses must navigate the intricacies of fee management to ensure financial viability. Every transaction processed through Authorize.net incurs a fee, coupled with applicable taxes, which are deducted from the customer’s payment. However, discrepancies in fee calculation can gradually erode profitability over time, highlighting the critical need for precise reconciliation mechanisms.

Introducing Automated Reconciliation with Cointab:

To address the challenge of fee miscalculations and ensure optimal financial health, businesses turn to innovative solutions like Cointab Reconciliation. This automated reconciliation software streamlines the arduous process of verifying transaction data, saving valuable time and resources. By seamlessly loading and reconciling data in any format, Cointab empowers users to define custom rules, fostering a tailored reconciliation experience.

Comprehensive Reporting for Informed Decision-Making:

One of the key features of Cointab Reconciliation is its ability to generate comprehensive reports, offering insights into transaction discrepancies and fee variances. The Authorize.net Payment Report meticulously records transaction details, including payment amounts, tax percentages, and payment modes, facilitating a holistic view of financial transactions. Additionally, the Authorize.net Rate Card provides clarity on applicable fees, empowering businesses to make informed decisions regarding transaction processing.

Essential Reports for Validating Authorize.net Payment Gateway Charges

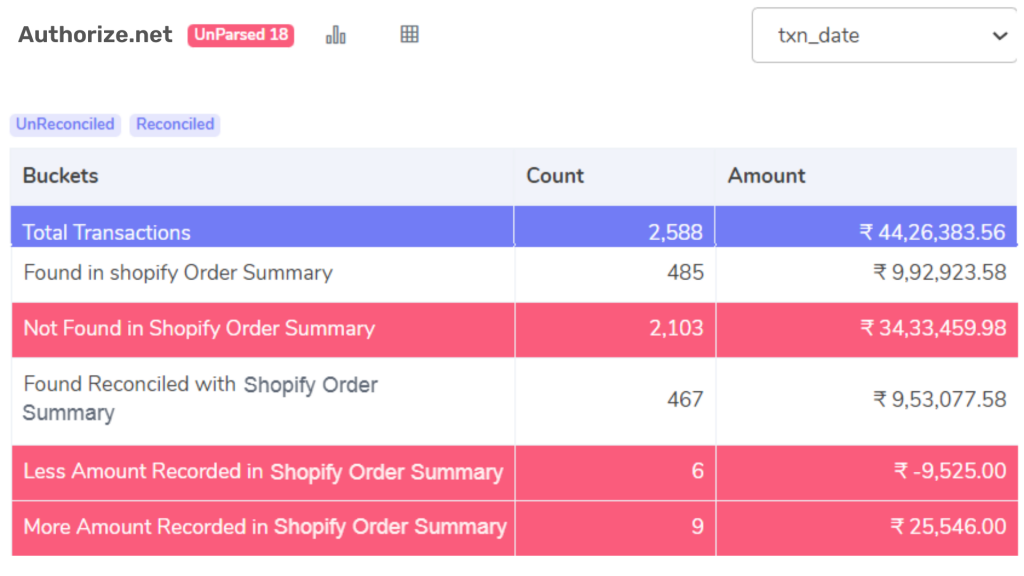

Cointab Reconciliation categorizes transactions into distinct segments, enabling businesses to pinpoint areas of concern with precision:

The reconciliation results are displayed below:

Correctly Charged Fees:

Transactions where the software-calculated fee aligns with the invoiced amount, ensuring accuracy in financial processing.

Overcharged Fees:

Identifies transactions where the software-calculated fee exceeds the invoiced amount, highlighting potential revenue loss.

Undercharged Fees:

Flags instances where the invoiced fee falls short of the software-calculated amount, minimizing revenue leakage.

Matching Settlement Amount:

Ensures parity between the settlement amount calculated by the software and the Authorize.net report, promoting financial transparency.

Mismatching Settlement Amount:

Alerts users to disparities between the software-calculated settlement amount and the Authorize.net report, necessitating further investigation.

Missing Settlement UTR:

Identifies transactions lacking a Unique Transaction Reference number, indicative of payment discrepancies requiring resolution.

Settled in Bank Account:

Highlights inconsistencies between the transaction amount in the bank statement and the Authorize.net report, streamlining the reconciliation process.

The utilization of automated reconciliation solutions such as Cointab Reconciliation presents a paramount advantage for businesses in their endeavor to optimize fee management and guarantee financial precision in Authorize.net transactions. Through the adoption of automation, companies not only streamline the verification process of Authorize.net charges, thereby minimizing the potential risk of revenue loss stemming from fee discrepancies, but they also gain access to invaluable insights crucial for effective dispute resolution with Authorize.net.

This transformative technology not only enhances operational efficiency but also empowers businesses to reclaim precious time and resources. By embracing automation, businesses fortify their financial processes, ensuring a resilient bottom line resistant to revenue leakage and poised for sustained growth and success in the dynamic landscape of online commerce. With Cointab Reconciliation at their disposal, organizations can navigate the complexities of fee management with confidence, armed with comprehensive data and actionable intelligence to drive informed decision-making and mitigate financial risks effectively.

Furthermore, the integration of automated reconciliation solutions into the operational framework of businesses fosters a culture of efficiency and adaptability, allowing teams to focus their energies on strategic initiatives rather than laborious manual tasks. This shift towards automation not only enhances productivity but also instills a competitive edge, enabling businesses to stay ahead in an increasingly competitive market landscape.

In essence, automated reconciliation solutions like Cointab Reconciliation represent more than just a technological advancement; they signify a paradigm shift in how businesses approach financial management. By harnessing the power of automation, organizations unlock new avenues for growth, innovation, and resilience, positioning themselves for long-term success in an ever-evolving digital economy.

Authorize.net Payment Report:

Records transaction date, payment amount, tax percentage, mode of payment, and issuing bank details.

Provides a comprehensive overview of financial transactions for businesses.

Facilitates informed decision-making and enhances financial transparency.

Authorize.net Rate Card:

Outlines validity dates and applicable percentages of tax and fees charged by Authorize.net.

Serves as a reference point for financial obligations.

Ensures compliance with regulatory requirements.

Leveraging these reporting tools:

Streamlines financial management processes.

Mitigates risks and optimizes revenue generation strategies.

Strengthens compliance efforts and fosters transparency in financial transactions.

Integration into business operations:

Enhances financial visibility.

Facilitates adherence to regulatory standards.

Supports operational excellence and sustainable growth.

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation