Looking for an alternative to FloQast for reconciliation? Then this is the right place to be. In this article, we cover various reconciliation software alternatives to FloQast so that you can pick the right one for your business.

An automated reconciliation software is a necessary tool for business. It plays an important role in the data reconciliation process as it automates the entire process right from the data upload, running reconciliation to export. Using the software has become an important aspect for the finance teams as them the tedious time and a lot of manual effort. Since the work is done manually the results are prone to have errors. Hence with the software, accurate results are generated without much effort.

FloQast is a software that provides many financial solutions such as financial functions, including financial close, reporting, and audit readiness. FloQast as a reconciliation tool gives users a centralization platform to manage their account reconciliation while reducing the risk of errors. The FloQast system enables centralized tracking for the finance team so that they can identify and resolve unknown errors. Along with this, it sends alerts when reconciliation is due or ready to review. FloQast is a software that gives finance managers a practical and easier way to manage reconciliation. Many processes, including bank reconciliation, clearing, credit card reconciliation, intercompany reconciliation, and other accounts, are automated by FloQast.

Key Features

- Centralized View of every transaction

- Controls enabled to track sign-offs

- Automated tie-outs with general ledger

- Users can select the reconciliation method

- Users can accurately verify trail balance.

If FloQast does not seem like the right reconciliation system for you, we have listed our picks for an alternate reconciliation software to FloQast in this article.

Evaluate these alternatives and pick a suitable software for your business

1. Cointab

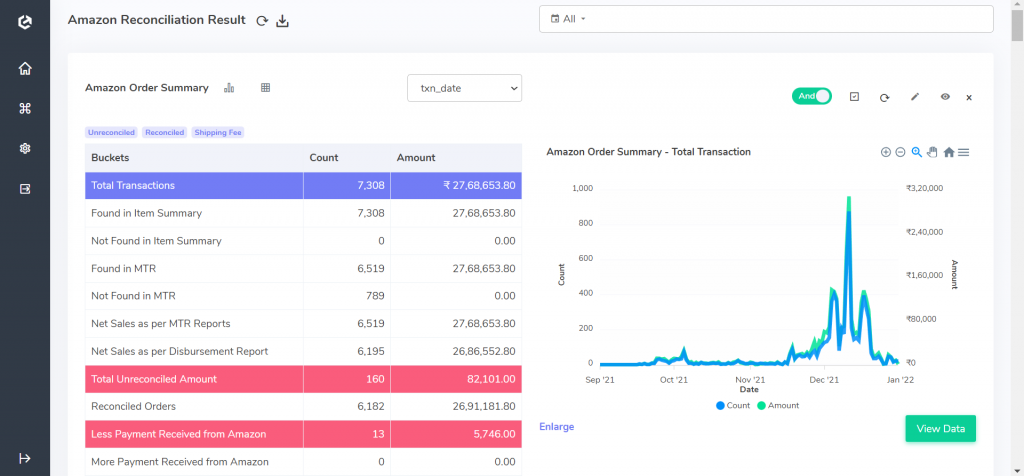

Cointab reconciliation aids in automating and streamlining the reconciliation procedure. It automates several repetitive procedures that take up a lot of the finance team’s time during the reconciliation process. It automatically loads data into the system in a variety of file types, such as PDF, XML, and JSON. The software can manage a significant amount of data, as it is scalable enough to meet the expanding needs of your organisation. The software enables a number of customizations in addition to these automated choices. It enables you to select a custom rules engine for logic conditions as well as a custom input format. Also, users are given the option to select a unique export format with particular data fields and columns.

The software’s reconciliation result is simple to interpret with numerous rows that present transactions of various categories. The overpaid/underpaid sums, as well as the missing payments, are indicated in the result. Organizations can use the result to raise claims against vendors or marketplaces in the event of any missing payments. The software also offers an exception-handling capability that enables users to add exceptions to transactions when payments are completed but still unaccounted for ensuring complete accuracy.

The software automates many reconciliation procedures, including fee verification, marketplace reconciliation (Amazon, Flipkart, Myntra, Nykaa, Ajio, TataCliq, and many more), bank reconciliation, OMS reconciliation, and ERP reconciliation. Use Cointab reconciliation to save the finance team time and effort.

2. BlackLine:

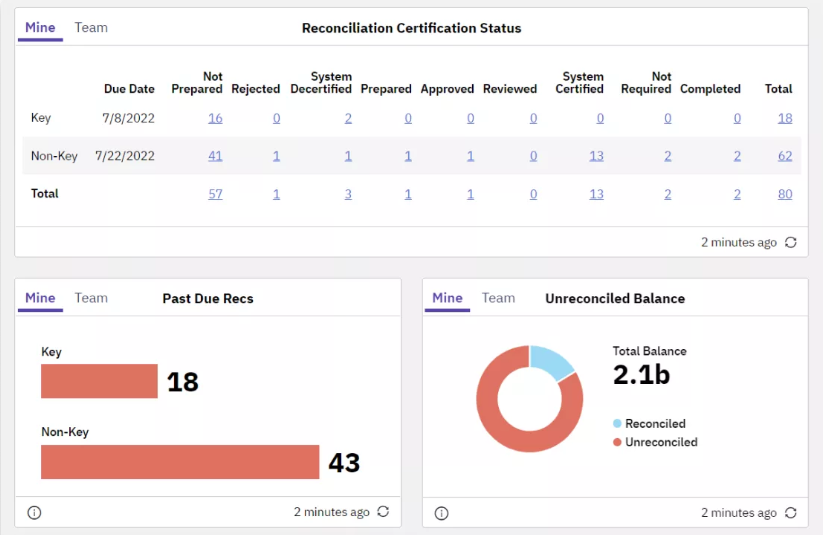

BlackLine offers a range of financial services which include accounts reconciliation credit management services, financial reporting analysis, and task management. Its account reconciliation tool makes it easier to improve accuracy and control over the reconciliation process by streamlining the reconciliation procedure. Standardized templates and workflows are provided by BlackLine for accountants as they can be used for preparation, approval, and review. In addition to these features, it also provides internal storage for documents. Additionally, because of its rule-based approach, it helps users quickly detect inconsistencies and reduces the likelihood of manual errors. Since the dashboard is cloud-based, users can access it from any location at any time to view and track results, ensuring complete transparency. The software also enables users to group ERPs and other entities while retaining the procedure easily. It allows one-to-one and one-to-many transaction matches when transactions are loaded in bulk to increase the efficiency of the transaction matching process. The software has established configurable rules and an exception-adding function to accurately match these transactions.

In the dashboard, users may view the results for matches, unreconciled transactions, and reconciled transactions with a complete audit trail. Consequently, using BlackLine to streamline transaction matching enables accurate, fully automated reconciliation.

3. Onestream

Onestream is one such software that helps in not only data reconciliation but also many other financial services. Its reconciliation features facilitate analysis and reporting, which makes it easier to match transactions. This software aims to eliminate the need for spreadsheets while matching transactions. It gives a statistical overview of financial facts to managers so that they can easily analyze data. The software also maintains a complete audit trail so that sources are known and errors are reduced. The Onestream system imports data directly from the bank so that high-risk transactions can be viewed in one place without much effort. The software also sends alerts for changes made in the trial balance so that managers can monitor these transactions closely. These features aid businesses in data reconciliation with accurate results and ease in analysis

4. ReconArt

ReconArt completely automates the reconciliation process, saving the finance team’s time and resources. Reconart gives users a better approach to control the reconciliation process with its dashboard and functionalities, increasing the operational effectiveness of the finance teams. To avoid wasting time on system cross-checks with other systems, the system also enables smooth connection with internal systems, ERPs, and platforms. The system is created to be user-friendly, flexible, and configurable for the ultimate customization of the financial team in order to support full operational efficiency. The system Reconart is a one-stop place for transaction matching and reconciliation because it is appropriate for all types of reconciliation processes.

ReconArt facilitates several processes, including enhanced journal entries, position holding, trade reconciliation, accounts payable and receivable reconciliation, and intercompany reconciliation. For accuracy and ease in streamlining these reconciliation processes, businesses opt for ReconArt

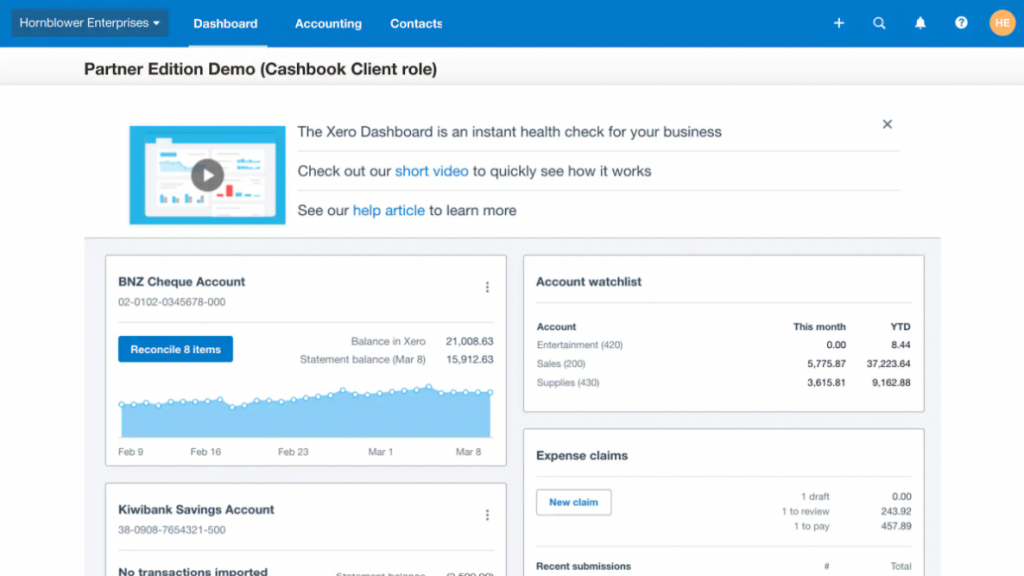

5. Xero

ReconArt completely automates the reconciliation process, saving the finance team’s time and resources. Reconart gives users a better approach to control the reconciliation process with its dashboard and functionalities, increasing the operational effectiveness of the finance teams. To avoid wasting time on system cross-checks with other systems, the system also enables smooth connection with internal systems, ERPs, and platforms. The system is created to be user-friendly, flexible, and configurable for the ultimate customization of the financial team in order to support full operational efficiency. The system Reconart is a one-stop place for transaction matching and reconciliation because it is appropriate for all types of reconciliation processes.

ReconArt facilitates several processes, including enhanced journal entries, position holding, trade reconciliation, accounts payable and receivable reconciliation, and intercompany reconciliation. For accuracy and ease in streamlining these reconciliation processes, businesses opt for ReconArt