This Reconciliation Process is done using the client’s ERP Database

Data from Tata Cliq and cliental data can differ greatly. because there are discrepancies between the two reports. We total up all the information down to the item SKU, check it against the Tata Cliq Reports, and display the variances between the numbers. Clients can more easily distinguish between orders, as well as between payments and fee levies, thanks to this.

Reports needed for reconciliation:

- Tata Cliq GST Report

- Tata Cliq Sales Report

- Tata Cliq Payment Report

- Reports from the client’s ERP (e.g., SAP, Tally, etc.).

Once the reports are taken and the reconciliation process is done the result is showcased in a very systematic format.

The Result is as follows:

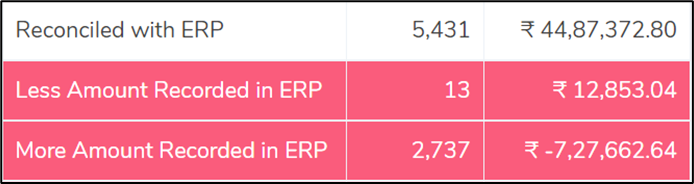

Tata Cliq GST Report vs ERP Report

The System checks all the data recorded in the client’s ERP (ERP) and compares the data with the Tata Cliq Sales (Invoice) report. It then differentiates the orders and highlights them as follows:

- Reconciled Orders:

- These are those orders whose amounts match.

- Less Settlement recorded in ERP

- The orders whose amount in the ERP is less than the amount in the Tata Cliq Sales report.

- More settlements recorded in ERP

- The orders whose amount in the ERP is more than the amount in the Tata Cliq Sales report.

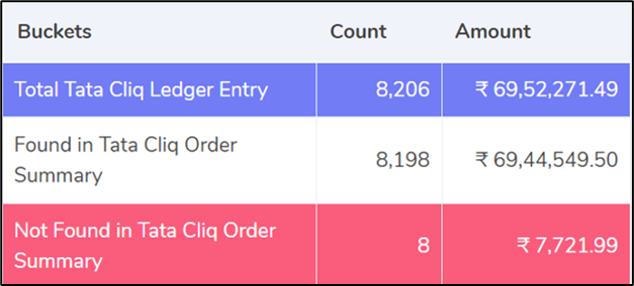

ERP – Tata Cliq Reconciliation

The System checks all the data recorded in Tata Cliq’s reports and compares the data with the client’s ERP. It then differentiates the orders and highlights them as follows:

- Total Tata Cliq Ledger Entry

- This shows the total Tata Cliq entries in the ERP.

- Found In Tata Cliq

- These are the orders that are recorded in the client’s ERP and the same are found in the Tata Cliq Reports.

- Not Found in Tata Cliq

- These are the orders that are recorded in the client’s ERP but not found in the Tata Cliq Reports.