In the realm of online commerce, Stripe stands tall as a globally trusted payment gateway, facilitating seamless transactions across borders. Leveraged by countless businesses and consumers alike, Stripe embodies reliability and security, fostering trust among users and driving sales to unprecedented heights. Harnessing Stripe’s prowess, businesses can effortlessly process payments via various channels including credit cards, debit cards, and online wallets. With its intuitive interface and robust security features, Stripe empowers buyers to transact with confidence, thus elevating sales and bolstering overall customer satisfaction.

Streamlining Transactions with Stripe: The Imperative of Reconciliation

As an e-commerce entity, your reliance on Stripe as a payment gateway is paramount, constituting the backbone of your transactional ecosystem. However, amidst the deluge of daily transactions, meticulously scrutinizing each payment received from Stripe becomes a Herculean task. Enter automated reconciliation software, a beacon of efficiency in the labyrinth of financial management.

Introducing Cointab Reconciliation: Your Automated Ally

Cointab Reconciliation emerges as a beacon of efficiency, seamlessly reconciling transactions from disparate sources to unearth discrepancies that may have eluded manual scrutiny. Within the realm of Stripe reconciliation, this software serves as a diligent watchdog, harmonizing Stripe reports with website data, ERP records, and bank statements to unveil inaccuracies or oversights in payments.

Essential Reports for Seamless Reconciliation

Stripe Settlement Report:

A comprehensive dossier documenting transactions processed through the Stripe gateway, offering insights into each payment’s intricacies.

Stripe Return Report:

A detailed log delineating RTO transactions facilitated via Stripe, shedding light on reversals and refunds.

Website Report:

An indispensable compendium cataloging orders initiated through your online platform, providing a holistic view of customer interactions.

ERP Report:

A repository housing transactions logged within the ERP system, serving as a cornerstone of financial record-keeping.

Bank Statement:

A definitive record reflecting payments disbursed by Stripe, serving as the ultimate arbiter of financial veracity.

Navigating the Reconciliation Landscape: Insights from Cointab

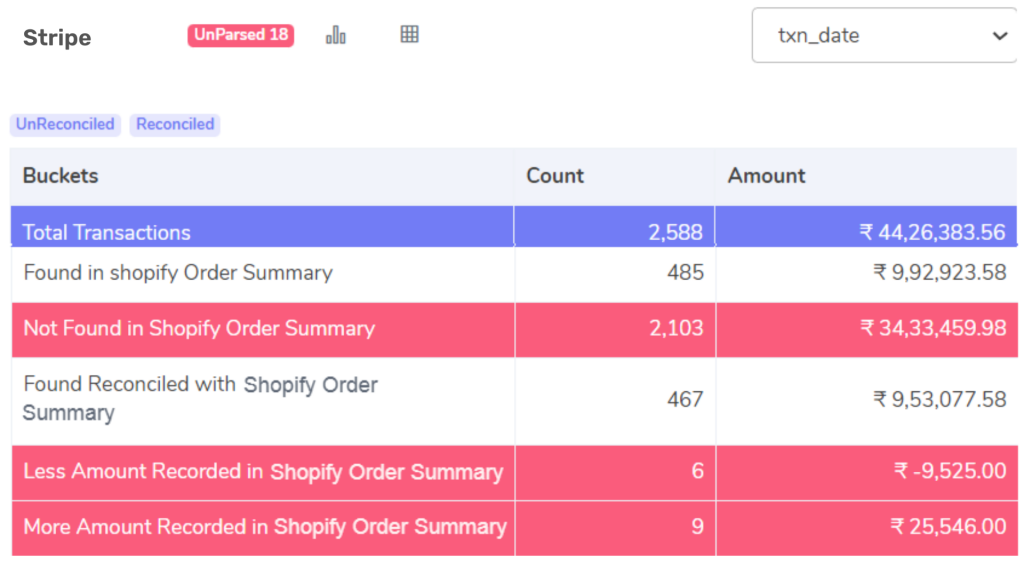

Stripe with Website Reconciliation

Found in Shopify Order Summary:

Transactions seamlessly mirrored across both website and Stripe reports, indicative of synchronization in transactional data.

Not Found in Shopify Order Summary:

Transactions present solely within the Stripe report, necessitating further investigation to ascertain their veracity.

Found Reconciled with Shopify Order Summary:

Transactions exhibiting congruent amounts across both website and Stripe reports, underscoring financial alignment.

Less Amount Recorded in Shopify Order Summary:

Instances where the website report reflects a lower transaction amount compared to the Stripe counterpart, warranting scrutiny and rectification.

More Amount Recorded in the Shopify Order Summary:

Contrary to the former, transactions wherein the website report overshadows the Stripe record, signaling potential discrepancies.

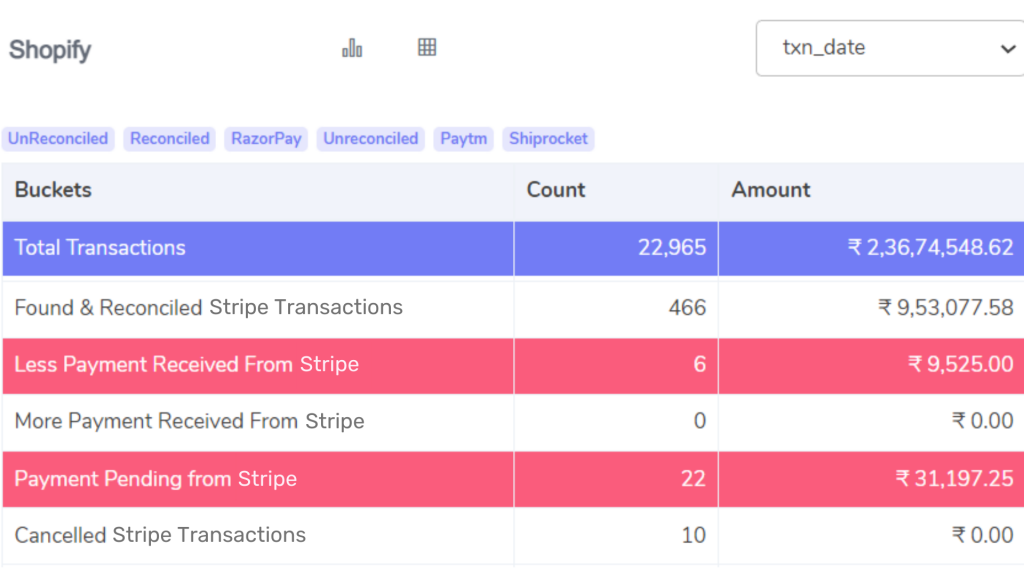

Website with Stripe Reconciliation:

Found and Reconciled Stripe Transactions:

Transactions corroborated across both website and Stripe reports, attesting to financial harmony.

Less Amount Recorded in Stripe:

Transactions showcasing diminished amounts within the Stripe report vis-à-vis the website record, necessitating reconciliation to rectify discrepancies.

More Amount Recorded in Stripe:

Conversely, transactions portraying augmented amounts within the Stripe report, warranting meticulous scrutiny to ensure financial accuracy.

Cancelled PayPal Transactions:

Orders ostensibly recorded in the website report but subsequently annulled by customers, as evidenced by the Stripe report.

Stripe Reconciliation with ERP:

Found and Reconciled with ERP:

Transactions seamlessly mirrored across both Stripe and ERP reports, indicative of financial congruence.

Less Amount Recorded in ERP:

Transactions underscoring diminished amounts within the ERP report relative to their Stripe counterparts, necessitating rectification.

More Amount Recorded in ERP:

Transactions exhibiting inflated amounts within the ERP report, warranting diligent scrutiny to ensure financial fidelity.

Not Found in ERP:

Transactions present solely within the Stripe report, conspicuously absent from ERP records, necessitating further investigation.

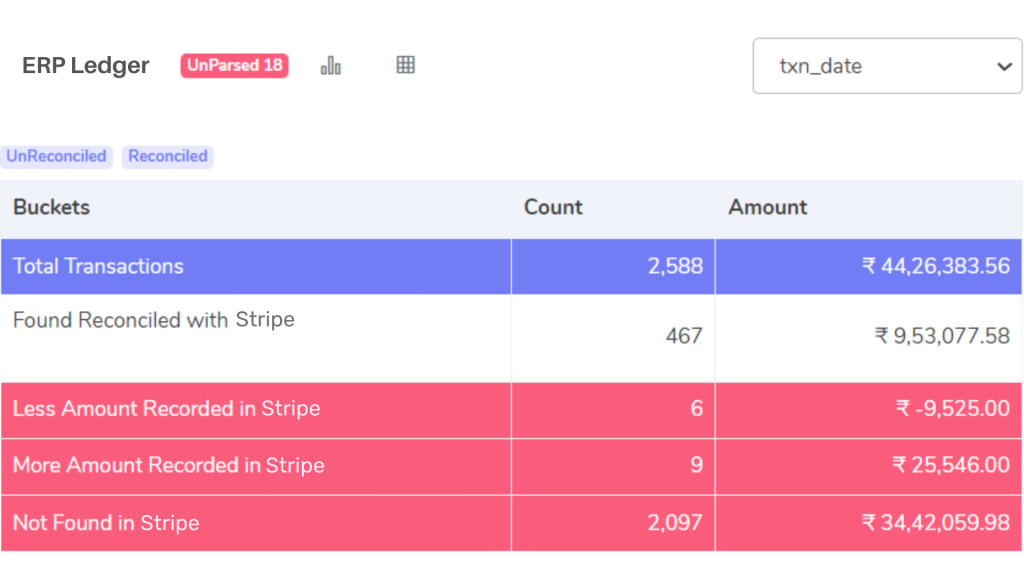

ERP with Stripe Reconciliation:

Found and Reconciled with Stripe:

Transactions validated across both ERP and Stripe reports, emblematic of financial alignment.

Less Amount Recorded in Stripe:

Transactions exhibiting diminished amounts within the Stripe report, necessitating reconciliation to uphold financial accuracy.

More Amount Recorded in Stripe:

Transactions showcasing augmented amounts within the Stripe report, indicative of potential discrepancies warranting closer examination.

Not Found in Stripe:

Transactions documented within ERP records yet conspicuously absent from the Stripe report, meriting thorough investigation.

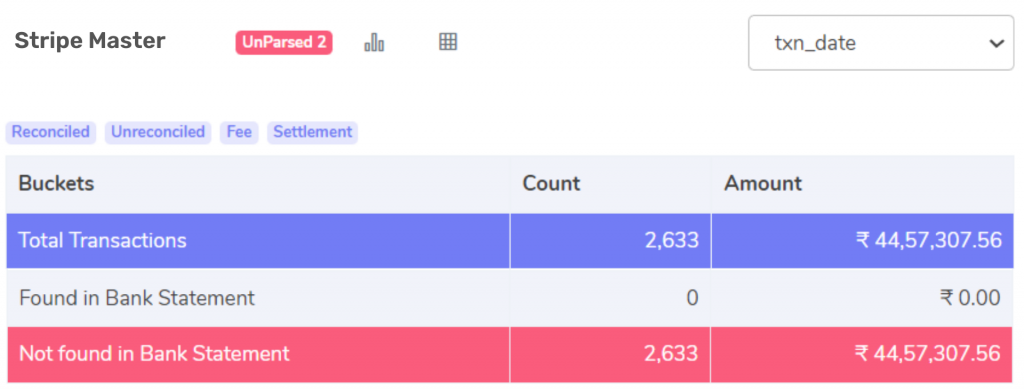

Stripe with Bank Reconciliation:

Found in Bank Statement:

Transactions corroborated across both Stripe and bank statements, affirming the receipt of payments.

Not Found in Bank Statement:

Transactions documented within the Stripe report yet conspicuously absent from bank statements, warranting further scrutiny.

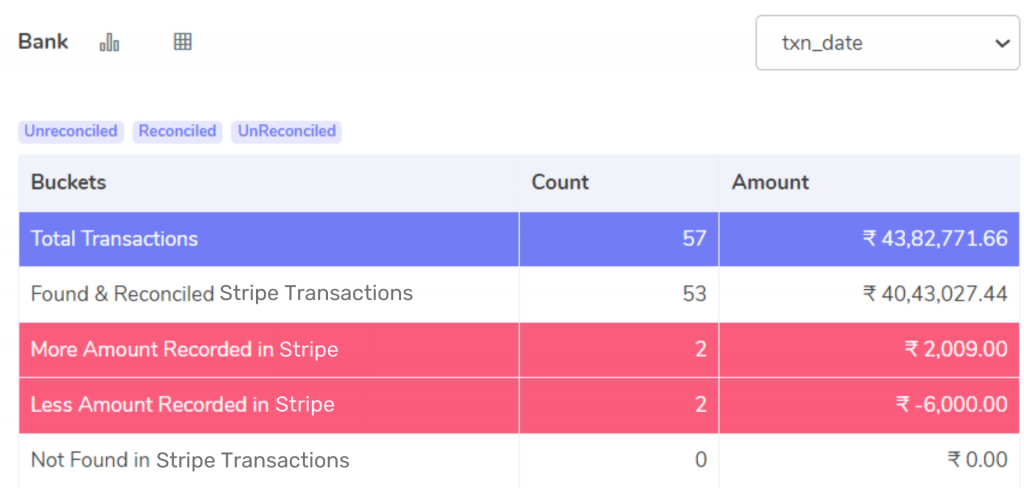

Bank with Stripe Reconciliation:

Found and Reconciled Stripe Transactions:

Transactions validated across both Stripe and bank statements, underscoring financial alignment.

More Amount Recorded in Stripe:

Transactions showcasing inflated amounts within the Stripe report compared to bank statements, necessitating reconciliation.

Less Amount Recorded in Stripe:

Conversely, transactions reflecting diminished amounts within the Stripe report, warranting rectification to ensure financial integrity.

Not Found in Stripe Transactions:

Transactions documented within bank statements yet absent from the Stripe report, mandating meticulous investigation.

Embracing Efficiency with Cointab Reconciliation

In a landscape fraught with financial intricacies, Cointab Reconciliation emerges as a beacon of efficiency, alleviating the burden of manual reconciliation and empowering businesses to navigate the labyrinth of transactions with ease. With its array of customizable features, this software enables users to tailor reconciliation processes to suit their unique business requirements, ensuring unparalleled accuracy and efficiency. Armed with intuitive insights gleaned from reconciliation results, managers can proactively identify discrepancies and initiate dispute resolutions, thereby safeguarding financial integrity and maximizing revenue potential.

Conclusion: A Paradigm Shift in Financial Efficiency

In the fast-paced realm of e-commerce, where every transaction bears the hallmark of opportunity, efficiency is paramount. By embracing automated reconciliation through Cointab, businesses can transcend the constraints of manual scrutiny and embark on a journey towards unparalleled financial efficiency. With Stripe reconciliation streamlined to perfection, businesses can unlock new realms of growth and profitability, secure in the knowledge that their financial foundations stand on solid ground.

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation