Stripe is an online payment processing company. It accepts credit and debit cards payments, digital wallets, and bank transfers. As Stripe is a trusted platform by many users to process their payments, many large e-commerce businesses opt for Stripe as their payment gateway partner to facilitate online recurring payments on their website. Having a payment gateway partner that a majority of users are familiar with helps them make purchases without any issues.

To partner with Stripe as a payment gateway partner a certain fee and tax has to be paid to them for each payment processed. Since a huge volume of transactions is processed every day, the fee and tax amount charged could be incorrect for a few of the transactions. In order to avoid making a loss it is necessary to reconcile these transactions.

When reconciling data manually a lot of effort and time is spent by the finance team. To simplify this task an automated reconciliation system can be used. Cointab Reconciliation is one such software that can automate the reconciliation process completely to generate accurate results. It calculates the fees, tax and settlement amount and reconciles it with the invoice to display reconciled and unreconciled transactions with ease.

Reports Required Stripe Payment Gateway Charges Verification

Stripe Payment Report

The transaction date, payment amount, tax percentage, mode of payment, issuing bank details etc. are displayed in this report

Stripe Rate Card

Stripe rate cards consist of the validity dates, fee and tax percentages etc.

Result:

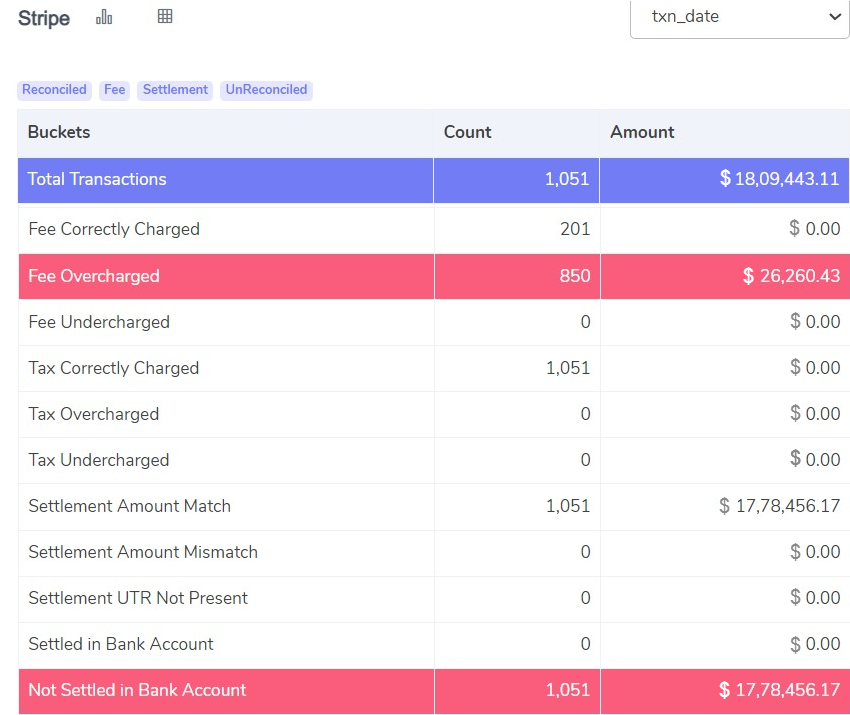

Fee Correctly Charged

For these transactions, the fee calculated by the software matches with fee amount in the invoice.

Fee Overcharged

These are the orders for which the fee calculated by the software is lesser than the fee amount in the invoice

Fee Undercharged

On these orders, the fee calculated by the software is more than the fee amount in the invoice.

Tax Correctly Charged

For these orders, the tax amount charged in the invoice matches the tax amount calculated by the software. The tax amount is calculated as 18% GST on the fee.

Tax Overcharged

These are the orders for which the tax amount calculated by the software is more than the tax amount in the invoice. The tax amount calculation is as given above.

Tax Undercharged

These are the orders for which the tax amount calculated by the software is lesser than the tax amount in the invoice. The tax amount calculation is as given above.

Settlement Amount Match

Settlement Amount = Amount Collected from Customer – Fee Charge – Tax Charge

With the help of the given formula, the software calculates the settlement amount and reconciles the amount with the Stripe report. These are orders for which the settlement amount calculated matches with the settlement amount report.

Settlement Amount Mismatch

Using the same formula, the software calculates the settlement amount and compares it with the Stripe report. These are the orders for which the settlement amount calculated matches with the settlement amount in the Stripe report.

Settlement UTR not present

UTR number is the ID used to identify payments transacted to the bank. Shown here are the orders of which the settlement UTR is not found which defines these orders as not transacted.

Settled in Bank Account

These are the transactions for which the order amount matches in the bank statement and the Stripe report. It means transactions are correctly settled in your bank account.

Not Settled in Bank account

For these transactions, the amounts in the bank statement do not match with the amount in the stripe report which means these transactions are not settled in your bank account.

Cointab Reconciliation presents the reconciliation output in an easy-to-interpret format which enables analysis of each transaction. With the help of the results, the finance can verify the fees, taxes, settlement amount etc without much effort. The results highlight the overcharged and undercharged transactions so that managers can analyze these transactions more closely. If the business has been overcharged on any order then they raise a dispute using the results and claim that overpaid amount from Stripe. With Cointab reconciliation get ready to analyze accurate results without any manual effort.