Looking for reconciliation software like Redwood? To help evaluate more reconciliation software alternatives we have listed our top 5 picks in this article. View the features and benefits of all the alternatives in one place so that your business can pick the right software for them.

Why is it necessary to use automated reconciliation software?

When reconciliation is done manually it takes up too much time of the finance teams and also the possibility of errors is high. To enable more accurate results while saving tremendous time. The exhausting tasks of checking between multiple reports and then calculating the amount of difference are also simplified with linking conditions and formulas. This has caused many businesses to shift to an automated solution.

Redwood is one such software that helps automate any business function ranging from data management, security, and file transfer to finance automation and reconciliation. Since we are discussing reconciliation in this article, let’s focus on Redwood’s automated reconciliation.

Redwood automation tool helps in centralized automation over end-to-end reconciliation processes. It lets users reconcile transactions between various reports. It simplifies manual tasks so that processes like bank reconciliation and invoice handling do not result in time wastage of the finance team and they can focus on other important tasks.

In case you need software focused mainly on reconciliation with many other features to help in the process, we have listed our top 5 picks for Redwood alternatives for reconciliation:

1. Cointab

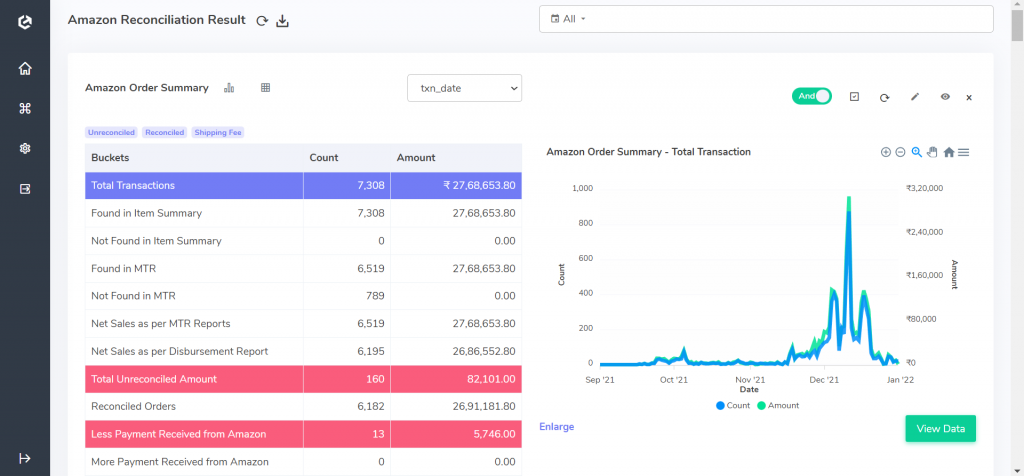

Cointab reconciliation is a software that helps automate and simplify the reconciliation process. It automates various repetitive tasks in the reconciliation process, which consumes a lot of the finance team’s time. It automatically loads data in a number of file formats including PDF, XML, and JSON to the system. The software is scalable as it can handle a large volume of data which can cater to the growing needs of your organization. Along with these automated options, the software offers various customisations. It lets you choose a custom input format and a custom rules engine for logic conditions. With this it also lets users pick a custom export format with selected data fields and columns. The reconciliation result generated by the software is easy to understand with various rows displaying values. In the result, the overpaid/ underpaid amounts along with missing payments are highlighted. With the help of the result, businesses can make claims with vendors or marketplaces in case of any less payments. To ensure total accuracy, the software also has an exception-handling feature that lets users add exceptions to transactions when payments are settled but still missing or not recorded.

The software automates various reconciliation processes which include payment gateway reconciliation, COD remittance, bank reconciliation, OMS reconciliation, ERP reconciliation, Marketplace Reconciliation (Amazon, Flipkart, Myntra, Nykaa, Ajio, TataCliq and many more) and fee verification. To save time and effort of the finance team switch to Cointab reconciliation.

2. Blackline

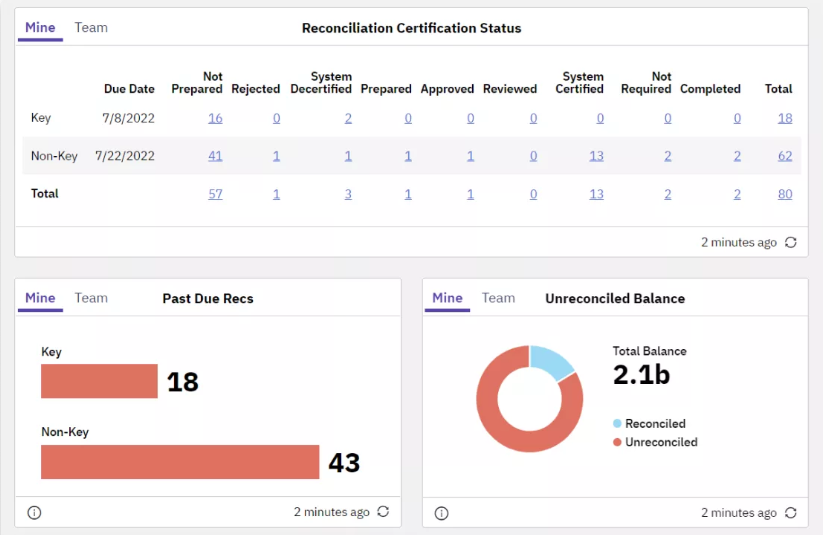

Blackline offers a range of financial close functions, including task management, financial reporting analysis, accounts reconciliation, and credit management. Its account reconciliation tool simplifies the process, enhancing accuracy and control. The system gives users benefits as it provides standardized templates and workflows for preparation, approval, and review, as well as internal documentation storage. To maintain financial accuracy the rule-based workflow helps users quickly identify discrepancies and avoid manual errors. The cloud-based dashboard provides complete transparency, allowing users to view and monitor results from anywhere at any time. Blackline also facilitates the grouping of ERPs and other entities while maintaining procedure rules. To simplify the transaction matching process the system gives the option of one-to-one and one-to-many matches, along with bulk data loading. With configurable rules and an exception-adding feature, the system helps ensure accurate transaction matching. Users can view matches, unreconciled, and reconciled transactions on the dashboard with a complete audit trail to show previous actions and changes. Blackline’s simplified transaction matching and automated reconciliation process provide accuracy and efficiency in the financial reconciliation process.

3. Xero

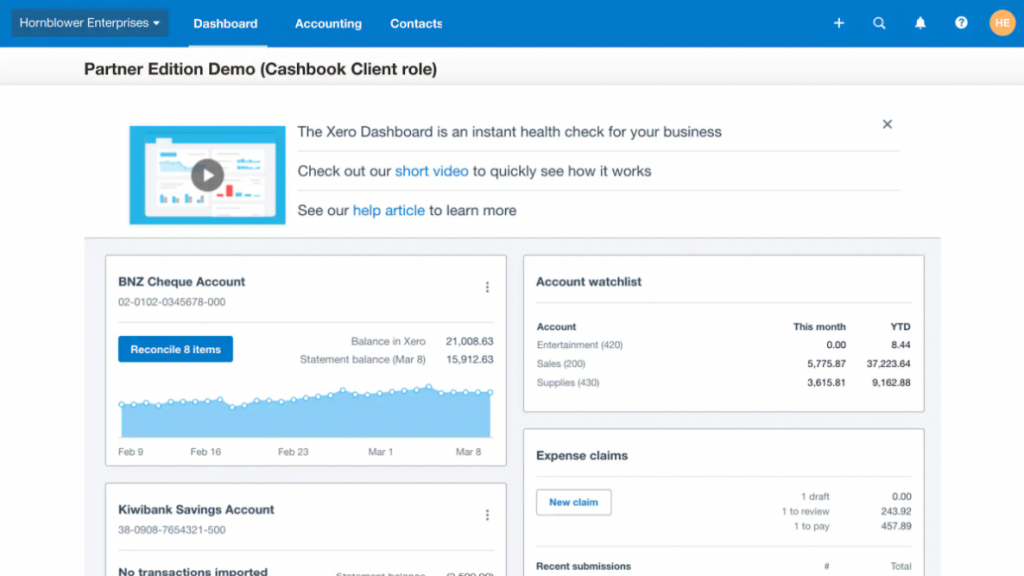

Xero provides various financial services such as bill payments, reimbursements, claiming expenses, bank reconciliation etc. The Xero software specializes in bank reconciliation, it imports transactions directly from the bank account and reconciles with the Xero ledger to show the result. Metrics and graphs are also generated with the reconciliation results to support decision-making and analysis. With Xero users can check bank reconciliation results every day. Xero’s reconciliation tool categorizes transactions and applies rules and gives users suggested matches which users can accept to reconcile transactions. The software also supports bulk transaction matching which is possible when transactions are grouped and rules are applied on the group as a whole. Since the reconciliation tool is integrated with other Xero features such as cashbook, the clients can be given access so that they can reconcile and view results.

4. ReconArt

ReconArt fully automates the reconciliation process which saves the time and spent of the finance team spent in the process. Reconart improves the operational efficiency of the finance teams as it gives users an enhanced way to control the reconciliation process through its dashboard and functions. The system also ensures seamless integration with ERPs, internal systems and platforms so no time is wasted in cross-checking with other systems. To facilitate full operational efficiency the system is designed to be user-friendly, flexible and configurable for the utmost convenience of the finance team. Reconart is a system that is suitable for every type of reconciliation process making it a one-stop solution for transaction matching and reconciliation.

ReconArt facilitates various processes such as bank reconciliation, positions holding, trades reconciliation, accounts reconciliation AP and AR, intercompany reconciliation and enhanced journal entries. To hence simplify such reconciliation processes, businesses opt for ReconArt.

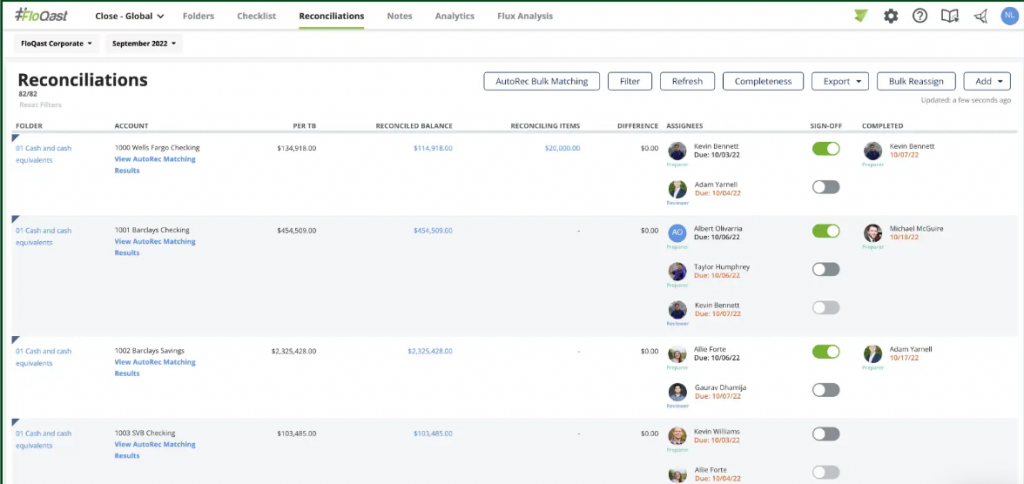

5. FloQast

FloQast is a comprehensive financial software solution that streamlines various financial functions, including financial close, reporting, and audit readiness. Its account reconciliation tool provides a centralized platform for users to manage reconciliation and reduce the overall risk of errors with its automated solution. With its smart reconciliation system, users can track time and identify unknown errors, which can be quickly resolved by the finance team through centralized tracking. Additionally, the FloQast system sends alerts to users when reconciliations are due or ready for review so the teams do not miss out on any payment issues. The system lets users select the most appropriate reconciliation method for each account so that the reconciliation is carried out in the most suitable manner. To facilitate analysis the system provides a centralized view of each transaction, enabling users to check balances, make comparisons, and review sign-offs. Automated controls are also put in place to track these sign-offs so that in case errors are made the source will be known. The FloQast reconciliation tool offers a practical solution for finance teams, enabling them to automate tie-outs with the general ledger and verify trial balances, ensuring complete accuracy and reduction of errors in the financial reconciliation process.

FloQast automates the reconciliation of various processes such as bank reconciliation, clearing, credit card reconciliation, intercompany reconciliation and other accounts.

With these reconciliation automation alternatives for Redwood, businesses can pick the right reconciliation software for their business. It is important to have a system that supports your other systems and other business rules otherwise you will end up with inaccurate results. To ensure complete accuracy and overall efficiency of the process the right reconciliation software that fits in seamlessly with your business would be a great asset.