Purplle is in an excellent position to rule the expanding Indian e-beauty sector. Through the creation of extensive user personas, the ability to try makeup, and product recommendations based on personality, search keywords, and purchase behavior, Purplle has developed a distinctive, highly personalized digital shopping experience for customers through its app. Due to purple’s popularity and reach, a merchant will benefit greatly from selling their beauty products on Purplle. Because purple is so well-liked by customers, a vendor will be able to sell their goods to a very large audience, which is undoubtedly advantageous to the seller. Maintaining records and ensuring that all transactions are carried out with the highest correctness, on the other hand, may be quite a challenge. It may result in merchants losing money despite their knowledge. Only precise reconciliation, which the technology created by Cointab provides, will be able to fix this issue.

With the help of this automated reconciliation system, a seller may quickly and precisely record and analyze transactions. A seller can quickly identify mistakes, correct them, or file a dispute with Purplle to get the inaccuracies or underpayments addressed.

The reconciliation process is as follows:

Reports needed for reconciliation

Purplle Order Report

All the transaction order details between the seller and the marketplace are recorded in this report.

Purplle Sales Report

In this report, all the sales transactions that are done via the Purplle marketplace are recorded. All the details about each order are recorded.

Purplle Return Report

In case an order is returned or canceled the details of each such order are present in this report.

Purplle Payment Report

The Payments done for each order along with the UTR id which is used for bank reconciliation are recorded in this report.

Payment Reconciliation

Sellers receive payments only after a few days of an order getting delivered to the customer. Since these transactions take place at a high rate daily it is very difficult to keep a track of these transactions. This process is very necessary as if payment verification isn’t done a seller might not even know how and when he is losing money, let alone be able to work on recovering it. This necessary and difficult task is made easier by the system of Cointab. The system links the reports and makes a summary based on this report. This summary contains every order detail and shows everything from item price to charges applied and payment received. After this, the summary is totaled up and the results are displayed in a very easy-to-read format. This makes analysis easy for the seller.

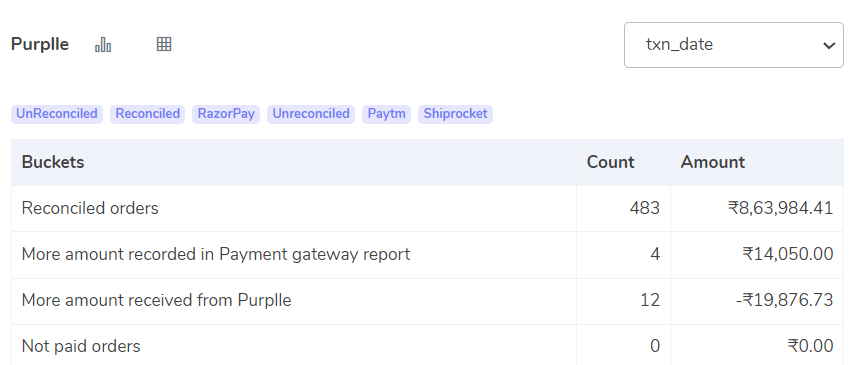

The result is displayed as follows:

The Result Displays:

- Reconciled with Order summary:

Transactions where the payment amount and the order summary amount are equal.

- More amount recorded in the Payment Report:

The amount recorded in the payment report exceeds the amount recorded in the Order summary.

- More Payment Received from Purplle:

In these transactions, the total amount recorded in the payment report is less than the amount recorded in the Order summary report.

- Not Paid Orders:

This line item lists all of the orders dispatched via Purplle for which the seller has not yet received payment.

Bank Reconciliation

After the Payment reconciliation process bank reconciliation is an important process for reconciliation. Bank reconciliation is done to make sure that every payment sent by Purplle is received correctly in the bank. Sometimes due to some errors technical or humane, payments either don’t get credited or are inaccurately credited. If this happens for a few transactions every day it can amount to huge losses for a seller. This important process is also precisely done by the system. The system links the settlement report with the bank statement and matches every transaction amount and verifies whether payments are received accurately or not.

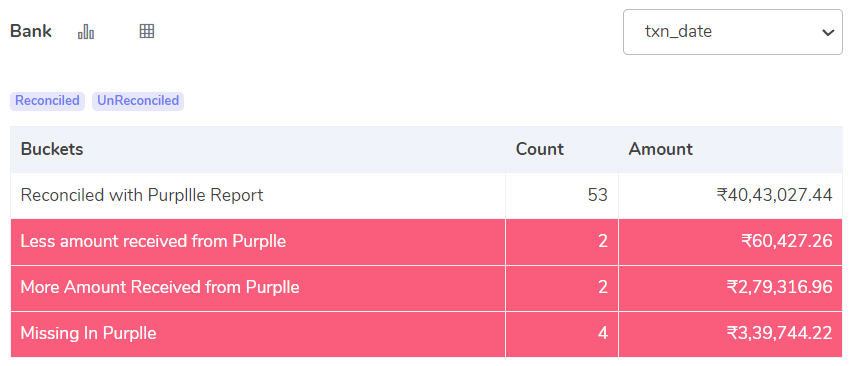

The result displays the following:

- Total Transactions

The total number of transactions in the bank statement is indicated here.

- Reconciled with Purplle Settlement Report

These are the bank transactions that correspond to the settlement amount that Purplle has guaranteed.

- Less Payment Received from Purplle

The amount in the bank is less than the promised settlement amount.

- More Payment Received from Purplle

The amount deposited in the bank exceeds the settlement sum that Purplle had promised.

- Missing In Purplle

These are bank transactions where the Purplle payment amount was received but was not recorded in the settlement report.

Inadequate reconciliation will make it impossible for businesses to stay competitive and relevant. Today’s business environment is getting more and more complicated. Verification must be done accurately in order to make decisions quickly and correctly. Using Cointab’s reconciliation technique is the most effective way to accomplish this.