Razorpay is a payment gateway that many businesses partner with, to facilitate online payments. They provide various online payment options like UPI, bank transactions and QR code scanning etc. to customers. Once payments are made, they forward it to the bank account of the company at a later date.

However, to carry out all these payments Razorpay charges a fee on each order payment they process. Since it is a business, there are multiple orders placed and payments made for the same on a daily. As a company, it is quite difficult to keep track of the fee charged on every payment. If you are getting overcharged on many orders, it can accumulate over time and lead to a huge loss.

Hence that’s where Cointab can help. Our automated reconciliation software can calculate the fee, tax and amount settled and reconcile it with Razorpay. It then produces a result that will show you on which orders the fee amount charged is correct or if the fee is overcharged on any order. This will help your company in the long run to save loads of money and time.

Reports Used for Razorpay Charges Verification

Razorpay Payment Report

It is a record of the transaction amount and date, fee and tax applicable, mode of payment and issuing bank of every order.

Paytm Rate Card

The fee and tax applicable and the dates between which these rates are applicable

Result

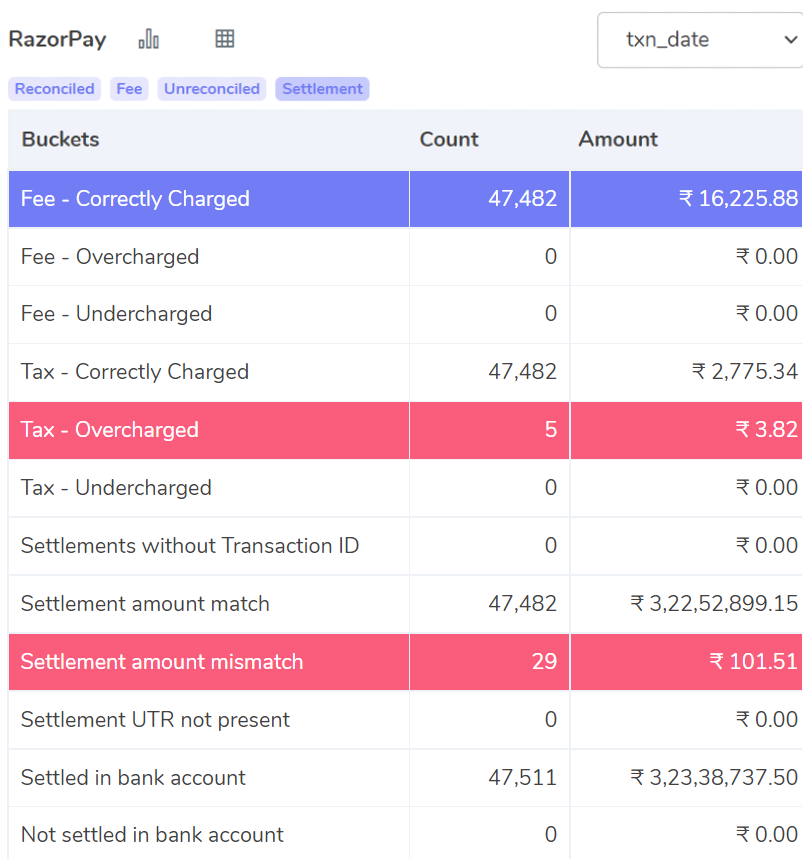

Fee – Correctly Charged

The fee amount charged on these orders is the same as the fee amount calculated by our software. This means that the fee charged is of the correct amount.

Fee – Overcharged

The fee charged on these orders is more than the amount calculated by our software. This means that the fee was overcharged on these orders

Fee – Undercharged

The fee charged on these orders is lesser than the fee amount calculated by our software. This means that the fee is undercharged on these orders.

Tax – Correctly Charged

The tax is taken as 18% of GST on fee. Our software calculates this amount and checks with the Razorpay report. And then displays the orders on which the tax amount charged is right.

Tax – Overcharged

The tax is calculated as mentioned above by the software. It checks with the tax amount recorded in the Razorpay report. Then it shows the orders on which the tax charged is more than the calculated amount.

Tax – Undercharged

The tax calculation is as mentioned before. The software then compares the calculated amount with the amount mentioned in the Razorpay report. When the calculated tax amount is lesser than the amount mentioned in the Razorpay report, those orders are displayed in this bucket.

Settlement without Transaction ID

These are the settlements which are recorded in the Razorpay report but the transaction ID of these settlements are not present in the Razorpay report.

Settlement Amount Match

Settlement Amount = Amount Collected from Customer – Fee Charge – Tax Charge

The given formula is used to calculate the settlement amount. Then, the software shows in the bucket the orders on which the settlement amount calculated matches the amount recorded in the Razorpay report

Settlement Amount Mismatch

The same formula given above is used for settlement amount calculation. Then, the software shows the orders on which the settlement amount calculated does not match the amount recorded in the Razorpay report.

Settlement UTR not present

UTR is a transaction ID necessary for checking if payment transactions are made to Bank. So, here the software shows those transactions for which UTR is not present. This means that since UTR is not present these orders cannot be transacted to the bank account.

Settled in Bank Account

These are the orders for which the final settlement amount is seen settled in the bank account. Our software displays these orders after comparing the Razorpay report with the bank statement.

Not Settled in Bank Account

Here, for these orders, the final settlement amount is not received in the bank. Our software displays these orders after comparing with the Razorpay report with the bank statement.

The above-given result is displayed in an easy-to-understand format with tables and graphs. Which makes it easier to analyse for finance teams of companies. The software also shows if any fee or tax amount is overcharged which helps you to avoid any losses over time. It also shows if the settlement amount is correct and if the final amount is actually credited to your bank account. This will help you keep track of every payment made and get the correct amount from the bank or Razorpay in case of less payment.

So if you are interested to run your business more smoothly and efficiently, try Cointab