PayU is a payment gateway that provides online payment services to companies and merchants. It accepts online payments via debit card, credit card, net banking, BNPL, digital wallets or QR scanning. As PayU is becoming an increasingly popular and well-known payment gateway many companies have partnered with PayU to facilitate online payments for customers. But to use PayU’s facilities a certain amount of fee is to be paid to PayU on each payment. For companies to keep track of fee charged on each order might be very difficult Hence, our automated reconciliation is useful to verify these charges. This way our software can conduct PayU payment gateway charges verification easily.

Reports Used for PayU Payment Gateway Charges Verification

PayU Payment Report

It is a record of each order and its respective transaction amount, transaction date, fee and tax percentage, mode of payment, and issuing bank.

PayU Rate Card

The fee and tax percentages and the validity dates are present in the PayU rate card.

PayU Payment Gateway Charges Verification Result

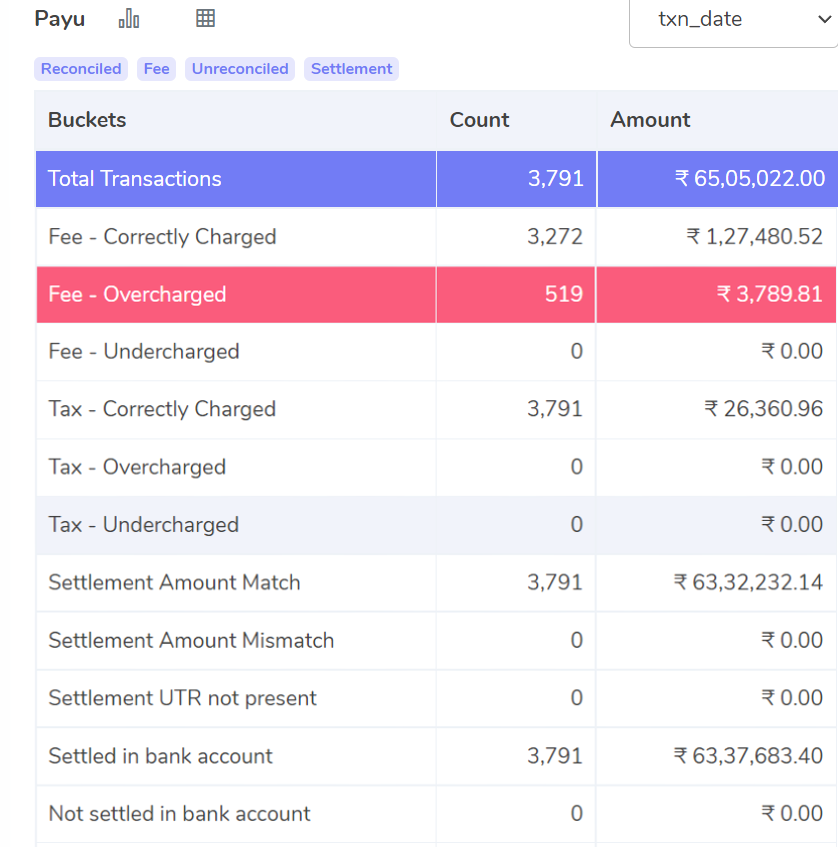

Fee – Correctly Charged

The calculated fee amount matches with the fee charged by PayU. This means that fee on these orders is correctly charged and hence displayed here.

Fee – Overcharged

The fee charged on these orders exceeds the calculated fee amount. This means that on these orders the fee is overcharged.

Fee – Undercharged

For these orders, the fee charged is lesser than the amount calculated by the software. This means that the fee is undercharged on these orders and hence displayed here.

Tax – Correctly Charged

The orders on which the tax amount charged matches the tax amount calculated by the software are displayed here. This bucket shows the orders on which the correct tax amount is charged. The tax is charged as 18% of GST on fee.

Tax – Overcharged

Here, the orders on which the tax amount charged by Payu is more than the tax amount calculated by the software are displayed. The tax is charged as per 18% GST on fee.

Tax – Undercharged

These are the orders on which the tax amount charged by Payu is lesser than the tax amount calculated by the software. This means that the tax is undercharged on these orders. The tax is charged as per 18% GST on the fee.

Settlement Amount Match

Settlement Amount = Amount Collected from Customer – Fee Charge – Tax Charge

The given formula is used to calculate the settlement amount. When the settlement amount recorded in Payu is equal to the amount calculated by the software, then those transactions are displayed here.

Settlement Amount Mismatch

After using the above-given formula for calculation of the settlement amount, our software displays the orders for which the settlement amount does not match with the settlement amount recorded in the Payu report.

Settlement UTR not present

The transaction ID used for identification in bank is UTR. When the UTR of transactions is missing it means that those transactions were not completed. The software displays those orders in this bucket.

Settled in Bank Account

When the final settlement amount recorded in Payu is reflected in the bank account, those transactions are shown here

Not Settled in Bank Account

As mentioned above, the software verifies the settled amount with the Payu report and the Bank statement. It displays the orders for which the amount to be settled in the bank is not found in the bank statement.

The final output, which displays the reconciliation outcome, is seen above. Finance teams can quickly keep track of the fees, taxes, and amounts deposited in the bank with the help of the software’s easy-to-understand result. Additionally, the software displays the overcharged or undercharged amount, which aids in your ability to prevent losses in the event of an overcharge.

Therefore, give our automated reconciliation software a try if you want to manage your company more effectively and prevent making unnecessary payments of fees.