PayPal is a popular payment gateway across the world. It provides various financial payment services to consumers. It accepts payment in the form of debit cards, credit cards, and QR codes to help consumers make payments with a trusted platform. Hence, many businesses partner with PayPal as a payment gateway partner. This helps e-commerce businesses provide a way to make payments to customers that would be the most secure, trustworthy and convenient to them. percentages etc.

To avail of PayPal’s services as a payment gateway partner a certain amount of fee has to be paid to them. So on each order processed the fee and the tax amount are deducted from the amount paid by the customer and the remaining amount is then credited to your account.

However, sometimes there are fee miscalculations which can lead to the amount being overpaid. This way if miscalculations are made on many orders then these accumulate and lead to a loss over time. To avoid these issues or to know exactly where you have been overcharged it is necessary to use an automated reconciliation software.

Cointab Reconciliation automates various tasks in the reconciliation process to help save the time and effort otherwise spent to reconcile data manually. It automates the data load in any input format, links and then reconciles the data with the help of a custom rules engine defined by the user to generate a comprehensive result.

The results generated display reconciled transactions with highlights for amount mismatches. These highlights for overcharged or uncharged amount helps the finance team track these transactions more closely as they can view the difference amount and all related details in a 360-degree view.

Reports Required PayPal Payment Gateway Charges Verification

PayPal Payment Report

In this report, the transaction date, payment amount, tax percentage, mode of payment, and issuing bank details are recorded.

PayPal Rate Card

The validity dates, applicable percentage of tax and fee are noted in the PayPal rate card.

Result

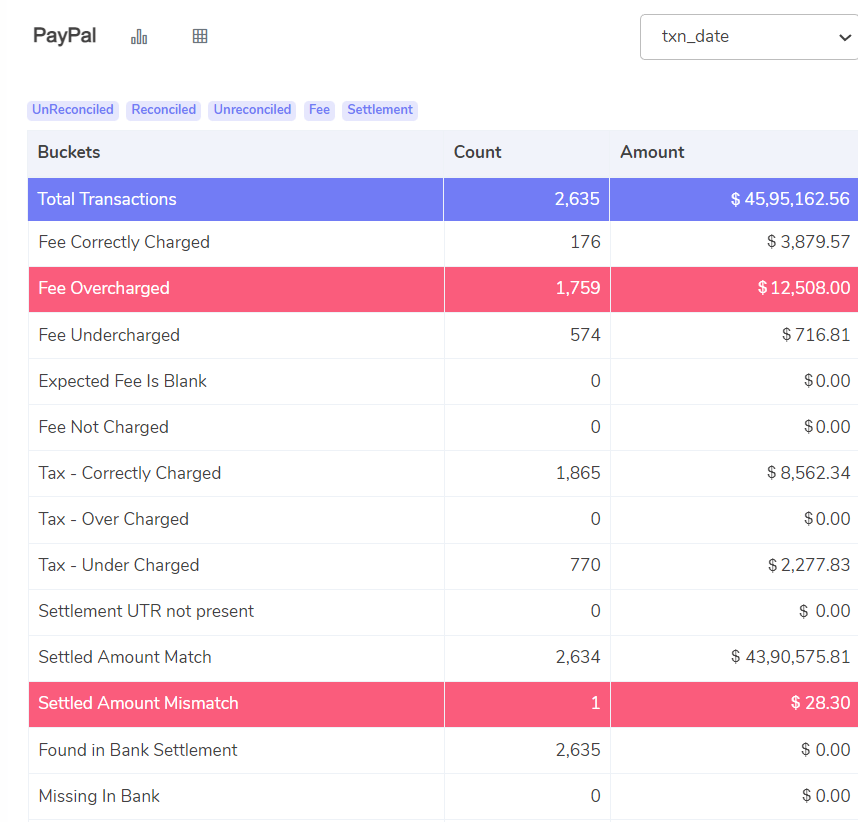

Fee Correctly Charged

The fees calculated by the softwares for these transactions match the fee amount in the invoice

Fee Overcharged

On these transactions, the fee amount calculated by the software is lesser than the fee amount in the invoice

Fee Undercharged

Shown here are the orders for which the fee amount calculated by the software is more than the fee amount in the invoice

Tax Correctly Charged

These are the transactions for which the tax amount charged in the invoice matches the tax amount in the invoice. The tax amount is calculated as 18% GST on the fee.

Tax Overcharged

On these orders, the tax amount calculated by the softwares is lesser than the tax amount in the invoice. The tax amount is calculated as mentioned above

Tax Undercharged

Shown here are the orders for which the tax amount calculated by the software is more than the tax in the invoice. The tax calculation is as mentioned above

Settlement Amount Match

The software calculates the settlement amount as Settlement Amount = Amount Collected from Customer – Fee Charge – Tax Charge and compares the amount with the PayPal report. In this bucket the settlement amount calculated matches with the settlement amount in the PayPal report.

Settlement Amount Mismatch

The software calculates the settlement amount shown above and compares the amount with the PayPal report. On these orders, the settlement amount calculated does not match with the settlement amount in the PayPal report

Settlement UTR not present

A UTR number is given to every payment sent to the bank. These are the transactions for which a UTR number is not found which means that these payments are not transacted to the bank.

Settled in Bank Account

Shown here are the transactions for which the order amount in the PayPal report matches with the amount in the bank statement which means these transactions are correctly settled.

Not Settled in Bank account

These are the transactions for which the amount in the bank statement does not match with the amount in the PayPal report.

To maximize efficiency in financial reconciliation Cointab Reconciliation simplifies the reconciliation process. It automates the repetitive task of reconciliation by handling the data loading, linking, cleaning etc to produce a comprehensive reconciliation result. With the help of the results, your business can know exactly how much amount is overcharged and on which orders. Your business can also claim the overcharged amount by when they raise a dispute with PayPal. With Cointab Reconciliation you can automate the entire PayPal charges verification.