Myntra is one of India’s primary e-commerce marketplaces, an online fashion and lifestyle store. It is a huge platform for online sales and is growing rapidly and shipping more than 10k products a day all over the country. Myntra aims to provide a hassle-free and comfortable shopping experience to customers across the nation. Ranging from various brands and products on its portal.

Myntra is a user-friendly interface with huge traffic growth annually and is the most popular online store across India. It allows sellers to manage their stores with cataloguing support, and a well-organized customer supply chain management. Thus, sellers can focus on their brand, in online shopping at Myntra. Since Myntra offers such benefits to sellers, it has a wide range of sellers who sell many products daily. To also be able to manage all these daily transactions and make pay-outs to so many sellers accurately can be very difficult. A company has to keep a tab on each order and verify the details with the reports and pay-outs Myntra provides. This task is not easy and is very time-consuming. Even So, it’s an important task.

So, how will Sellers find Assurance that they are provided with correct details and are remunerated correctly?

A system developed by Cointab can help a seller find the very Assurance. All that needs to be done is upload the required data and the system automatically records all data and calculates whether costs are charged right and whether remuneration is received correctly. It shows all the necessary data and verifies it and also shows the differences and if any errors are found. All the seller has to do is ask its Finance team to analyze this result and fix the issues with Myntra.

This Reconciliation process is done as follows

Reports Required from the Myntra portal:

- Seller Order Detail

- It includes the final status of all orders in a month

- Sales Revenue Report

- It includes the invoice number of all orders and the GST details.

- PG Forward Settlement Report

- It includes the logistics fee, commission charges, settlement amount, and UTR of all delivered orders in a month.

- PG Reversal Settlement Report

- It includes the logistics fee, commission charges, settlement amount, and UTR of all canceled and exchanged orders in a month.

- TCS reports

- It includes all the canceled order details, all the exchanged orders, and all the canceled orders, which were canceled after the shipment process started in the RTO sheet.

- Non-Order Settlement Report

- It includes all the marketing charges and compensation for fake orders (wrong product returned). This report is not specific to orders. It contains UTR for bank verification.

The Verification process is done in Two stages

The first stage of verification is based on the item level of invoice verification, whether the client received the invoice for expected orders or not. Aging is also possible depending upon the client’s requirements.

Aging means the time lap between the delivered date of orders and the settlement date (Payment receiving date). For a successful sale, expecting an invoice promptly is meaningless according to the payment policies of the marketplace, the client may wish to classify pending orders of aging between 0 to 15, 15 to 30, 30 to 45, and likewise.

First Stage

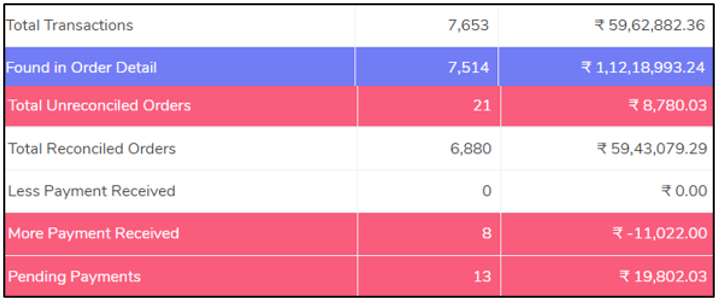

Pending payments, less amount received, and the More amount received are highlighted based on the invoice amount of each order.

Second Stage

According to the settlement reports the system checks whether the client has received the money in their bank correctly or not. According to the UTR given in the settlement reports and bank statement, the settlement amount is verified.

The settlement amount from the Forward Settlement report, the Reversal Settlement report, and the Non-Order Settlement reports are compared against the transaction amount given in the bank statement. Based on the difference of settlement amount to transaction amount orders are then categorized as reconciled and less payment and more payment received.

Sales Item Reconciliation

- Total Transactions

- This is the Total Expected amount from Myntra as per the Myntra GST reports.

- Net Sales as Forward & Reversal Reports

- This is the Net Sales as per the PG forward report and Reversal report.

- Total Unreconciled Orders

- This Line item represents all the orders for which the expected net sale calculated using the GST report does not match the net sales in the settlement report.

- Reconciled Orders

- This Line item represents all the orders for which the expected net sale calculated using the GST report matches the net sales in the settlement report.

- Less Payment Received from Myntra

- These are the orders for which the amount received from Myntra is less than what is reported in the Myntra GST Report.

- More Payment Received from Myntra

- These are the orders for which the amount received from Myntra is more than what is reported in the Myntra GST Report.

- Pending Payment from Myntra

- This represents the transaction where the payment is not received from Myntra.

Bank Statement Reconciliation:

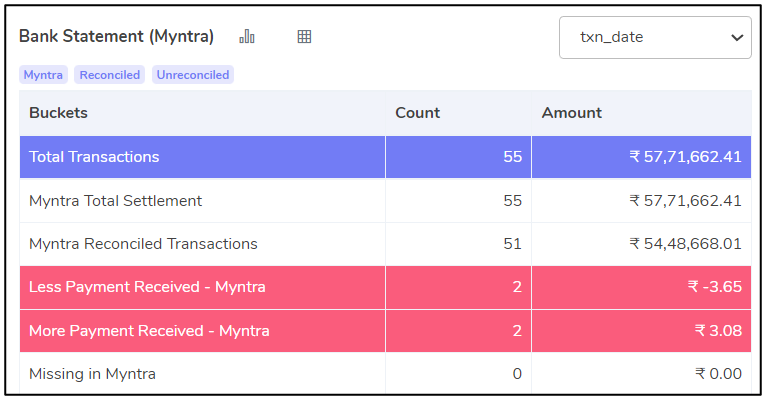

In the bank statement, the Promised amount from Myntra is calculated from the Forward, Reversal Settlement Reports, and Non-Order Settlement Reports. This promised amount is compared against the transaction amount of the bank statement report and according to the difference between the promised amount and transaction amount, these transactions are classified as Reconciled and more payment or less payment received.

Example

- Total Myntra settlements

- These are the total Myntra transaction in the bank.

- Reconciled with Myntra Settlement Report

- These are the transactions in the bank which are matching with the settlement reports by Myntra.

- Less Settlement Received from Myntra

- The amount received in the bank is less than the settlement amount promised by Myntra.

- More Settlement Received from Myntra

- The amount received in the bank is more than the settlement amount promised by Myntra.

- Myntra Settlement Received but Missing from Settlement Report.

- These are the transactions in the bank where the Myntra settlement amount has been received but the same has not been found in the settlement report.

To See the Fee Verification process, Click Here