In this digital age, while online shopping customers rely on online payment services. So, businesses usually partner with some payment gateway providers to facilitate online payments. MobiKwik is one such payment service provider that assists in online payments and makes online transactions easier. Along with that, it has many other provisions like digital wallets, credit facilities, investments and recharge etc. Hence in order to be inclusive of many payment types and provide multiple payment options to customers, various businesses are partnering with MobiKwik

However, MobiKwik charges a fee to avail of these facilities. To partner with MobiKwik, a fee is supposed to be paid on each payment processed. So, first MobiKwik collects the expected order payments from customers and deducts the fee and tax to be charged. After which it deposits the final settlement amount in your bank account. Hence, as you see the fee, tax, settlement amount and the amount finally deposited in the bank on order might be difficult to keep track of, as there are thousands of orders processed on a daily.

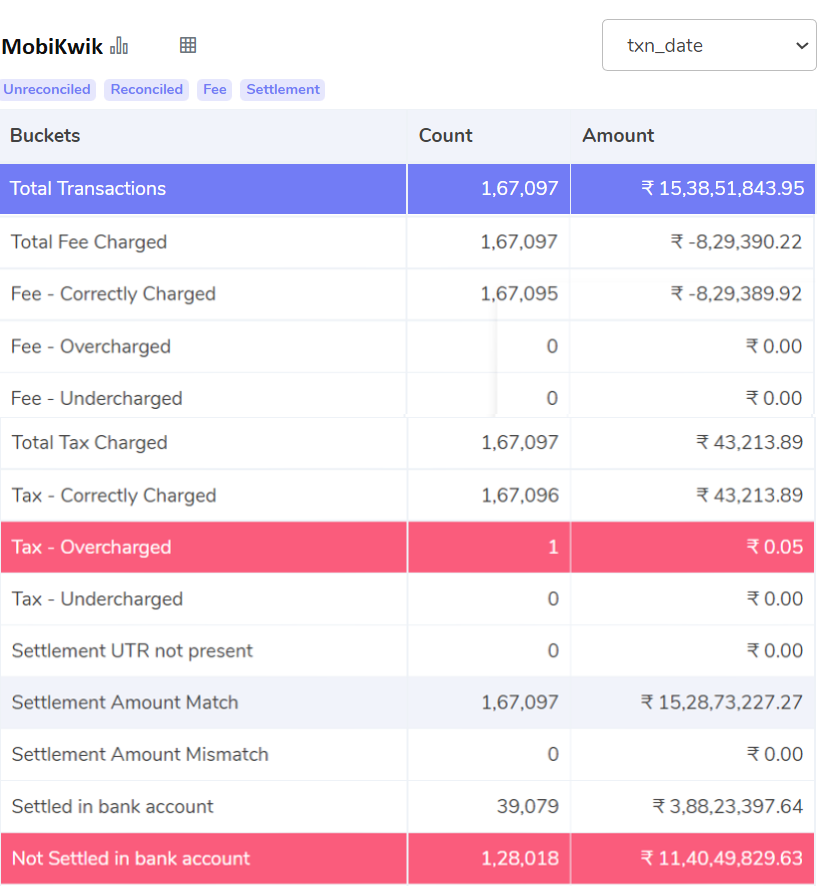

Hence that’s where our automated reconciliation software can be useful. As it can verify the fee, tax, settlement amount and the final amount deposited in the bank for you easily. It also shows exactly on which orders any amount is overcharged or undercharged or if the amount is incorrect. This way our system completely automates the MobiKwik Charges Verification process for you.

Reports Used for MobiKwik Payment Gateway Charges Verification

MobiKwik Payment Report

The transaction amount, transaction date, fee and tax percentage, mode of payment, and issuing bank are all available in this report

MobiKwik Rate Card

The fee and tax percentage and its validity dates are available in the MobiKwik rate card.

MobiKwik Payment Gateway Charges Verification Result

Fee – Correctly Charged

The software calculates the fee amount and then checks with the MobiKwik report. Then displays in this bucket the orders on which the fee amount matches in both the reports.

Fee – Overcharged

Here, the software calculates the fee amount and checks with the MobiKwik report. After which it displays the orders on which the fee amount charged exceeds the calculated fee amount.

Fee – Undercharged

For these orders, the software calculates the fee amount and checks with the MobiKwik report. Then it displays the orders on which the fee amount charged by MobiKwik is lesser than the calculated amount.

Tax – Correctly Charged

The tax amount to be charged is calculated by the software and compared with the MobiKwik report. When the tax amount charged by MobiKwik is the same as the calculated amount, those transactions are displayed here. The tax amount is considered as 18% GST on the fee.

Tax – Overcharged

The tax amount supposed to be charged is calculated by the software and compared with the MobiKwik report. When the tax amount charged by MobiKwik is more than the calculated amount, then those transactions are shown here. The tax amount is calculated as 18% GST on the fee.

Tax – Undercharged

Here, the tax amount supposed to be charged is calculated by the software and compared with the MobiKwik report. When the tax amount charged by MobiKwik is lesser than the calculated amount, then those transactions are shown here. The tax amount is calculated as 18% GST on the fee.

Settlement Amount Match

Settlement Amount = Amount Collected from Customer – Fee Charge – Tax Charge

The settlement amount is derived using the above formula. Here are the orders for which the settlement amount paid by MobiKwik matches the calculated amount.

Settlement Amount Mismatch

The software uses the formula as shown above for calculating the settlement. Here, it shows the orders for which the settlement amount paid by MobiKwik is not the same as the calculated settlement amount.

Settlement UTR not present

UTR is used as a transaction identifier in the bank. But when the UTR for transactions is not available then those transactions are considered as not completed as they cannot be identified.

Settled in Bank Account

The software verifies with the bank statement and the Mobikwik report and displays those transactions found in both the reports. These transactions are considered settled in the bank

Not Settled in Bank Account

The software verifies with the bank statement and the MobiKwik report and displays the transactions found in the MobiKwik report but not in the bank statement. So, these transactions are considered not settled in the bank.

The above-shown result is the output generated by our software after the completion of the reconciliation process. It verifies the fee and tax charged on all the orders and the final amount settled in the bank. While also displaying the transactions where fee or tax is overcharged or if any amount is not settled in bank. Which helps avoid any unnecessary loss.

So, if you want to automate your MobiKwik Charges Verification, then try our automated reconciliation software.

Get started with Cointab!

Recent Posts

- Optimize Orion ERP: Seamless Reconciliation with Cointab

- Perfecting Tally ERP Reconciliation with Cointab’s Cutting-Edge Solutions

- Infor CloudSuite ERP: Streamlined Solution Through Automated Reconciliation

- IPS ERP Reconciliation: Redefining Seamless Financial Harmony

- Unlocking Excellence: A Dive into Epicor Eclipse ERP Reconciliation