Financial reconciliation is a crucial process for any business to ensure the accuracy and integrity of its financial data. It involves comparing and matching financial transactions recorded in a company’s financial system, such as sales, purchases, and payments, with those reported by external sources, such as banks, payment gateway partners, and vendors.

While financial reconciliation is vital for maintaining accurate financial records and preventing fraud, performing it manually can be laborious, time-consuming, and an error-prone task. It requires a significant amount of time, effort, and attention to detail to identify and resolve discrepancies between the different sets of financial data. Moreover, manual reconciliation can be inefficient, leading to delays in financial reporting, and potentially resulting in missed opportunities or financial losses.

To overcome these challenges, businesses can leverage financial reconciliation software solutions like Cointab Reconciliation and Sage. These software solutions automate the reconciliation process by using algorithms and machine learning techniques to match financial transactions from different sources accurately. They provide real-time updates and alerts to help businesses quickly identify and resolve discrepancies, reducing the risk of errors and fraud. Additionally, financial reconciliation software solutions can streamline the reconciliation process, enabling businesses to save time, increase efficiency, and enhance the accuracy and integrity of their financial data.

Cointab Reconciliation and Sage are two popular financial reconciliation software solutions that have gained significant popularity in recent years. Both of these platforms offer advanced features and capabilities that can help businesses reconcile their financial data with ease and accuracy. However, each of these solutions comes with its own unique set of features, capabilities, and limitations, which can make it challenging for businesses to decide which platform to choose.

In this article, we’ll take an in-depth look at Cointab Reconciliation and Sage, comparing the two software solutions based on their features, usability, pricing, and customer support. We’ll explore the strengths and weaknesses of each platform, so you can make an informed decision about which one is right for your business.

Before we dive into the comparison, let’s take a closer look at each of these financial reconciliation software solutions.

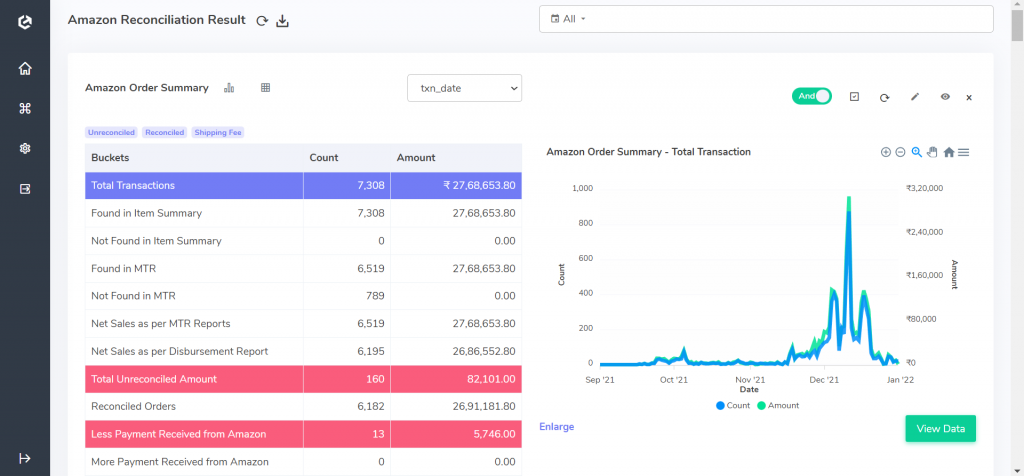

Cointab Reconciliation is a cloud-based financial reconciliation software solution that offers a range of tools and features to help businesses reconcile their financial data. Cointab Reconciliation is designed to be user-friendly, with an intuitive interface that makes it easy for users to navigate and access the features they need. The software offers a range of features, including marketplace reconciliation, paymentgateway reconciliation, bank reconciliation, Courier partner reconciliation, etc. Additionally, Cointab Reconciliation integrates with a range of third-party applications to make it easy for businesses to manage their financial data across multiple platforms.

Sage, on the other hand, is a comprehensive financial management software solution that offers a range of features, including financial reconciliation. Sage offers a range of reconciliation tools, including bank reconciliation, credit card reconciliation, and vendor reconciliation. The software is highly customizable, allowing businesses to tailor the platform to meet their specific needs. Additionally, Sage offers a range of add-ons and integrations, including payroll management and customer relationship management, to provide businesses with a comprehensive financial management solution.

Cointab Reconciliation

Cointab Reconciliation is a powerful financial reconciliation software solution that offers advanced technology to automate data input, clean up data, and execute rules to identify reconciled and unreconciled transactions. It is highly versatile and can handle various file formats and data structures, with a customizable rules engine to fit specific business requirements. The software generates reports on a universal dashboard, allowing easy analysis of financial data and maintaining an accurate audit trail.

Cointab Reconciliation integrates seamlessly with other accounting, ERP, and banking software, making it a flexible and scalable solution. Its web-based architecture also allows for easy access from a range of devices, including desktops, laptops, tablets, and smartphones. Additionally, scheduling reconciliation to run automatically in real-time, hourly, weekly, or monthly can enhance productivity and reduce manual work.

Features:

- Advanced technology for automation of financial reconciliation processes

- Versatility in handling various file formats and data structures

- Customizable rules engine to fit specific business requirements

- Generates reports on a universal dashboard for easy analysis of financial data

- Seamless integration with other accounting, ERP, and banking software

- Web-based architecture for easy access from multiple devices

- Automatic scheduling for enhanced productivity

Sage

Sage is a comprehensive reconciliation tool that helps businesses manage their financial transactions and accounts. The software integrates several accounting functions, including budgeting, invoicing, and inventory management, to provide a comprehensive platform for financial reconciliation and reporting. It offers a user-friendly interface, automated workflows, and extensive reporting capabilities, making it a popular solution for businesses of all sizes.

One of the key benefits of Sage is its user-friendly interface, which makes it easy for businesses to navigate and use. The software offers a range of automated workflows, which streamline financial reconciliation processes and reduce manual work. Additionally, Sage’s extensive reporting capabilities enable businesses to analyze their financial data and generate detailed reports, making it easier to maintain an accurate audit trail. The software also integrates seamlessly with other accounting, ERP, and banking software, allowing businesses to manage their financial data across multiple platforms.

Features:

-

- User-friendly interface that makes it easy to navigate and use.

- Offers a range of automated workflows that streamline financial reconciliation processes and reduce manual work.

- Extensive reporting capabilities that enable businesses to analyze their financial data and generate detailed reports, making it easier to maintain an accurate audit trail.

- Highly scalable solution that can be tailored to meet the specific needs of different businesses.

- Can handle large volumes of financial data and transactions, making it suitable for businesses of all sizes.

- Integrates seamlessly with other accounting, ERP, and banking software, allowing businesses to manage their financial data across multiple platforms.

- Has many different accounting tools.

In summary, Sage is a popular reconciliation tool that offers a range of benefits for businesses, including a user-friendly interface, automated workflows, extensive reporting capabilities, and scalability. However, it may also be expensive and complex to use, particularly for smaller businesses.

In conclusion, financial reconciliation software solutions like Cointab Reconciliation and Sage offer advanced features and capabilities to help businesses reconcile their financial data with ease and accuracy. Both platforms have their unique strengths and weaknesses, which can make it challenging for businesses to choose the right one. Cointab Reconciliation offers advanced technology, versatility, and seamless integration with other software, making it a flexible and scalable solution. On the other hand, Sage offers a comprehensive platform, a user-friendly interface, and extensive reporting capabilities, making it popular among businesses of all sizes. Ultimately, businesses need to carefully consider their specific needs and budget to choose the right financial reconciliation software solution for their organization.