Cashfree is a company that offers businesses and other merchants online payment services. It collects payouts, provides UPI and collects recurring payments easily. Many businesses have collaborated with Cashfree to enable online payments for customers as Cashfree is becoming an increasingly well-known and popular payment gateway.

However, in order to use Cashfree’s services, a set fee and tax on each transaction must be paid. It could be very troublesome for firms to keep track of the taxes and fees made on every order. Likewise, to keep a record of the total that was ultimately paid to the bank is almost impossible. All of these issues can be solved by our automated reconciliation as it is useful for verifying these payments. Using our software you can check the charges paid and also verify if there are any overcharges, undercharges, or incorrect payments. As a result, you’ll be able to avoid paying any unwanted taxes or fees.

Reports Used for Cashfree Payment Gateway Charges Verification

Cashfree Payment Report

Each order’s corresponding transaction amount, date, fee and tax percentage, payment method, and the issuing bank are included in this report.

Cashfree Rate Card

The Cashfree rate card includes the applicable fee and tax percentage as well as the dates it’s effective.

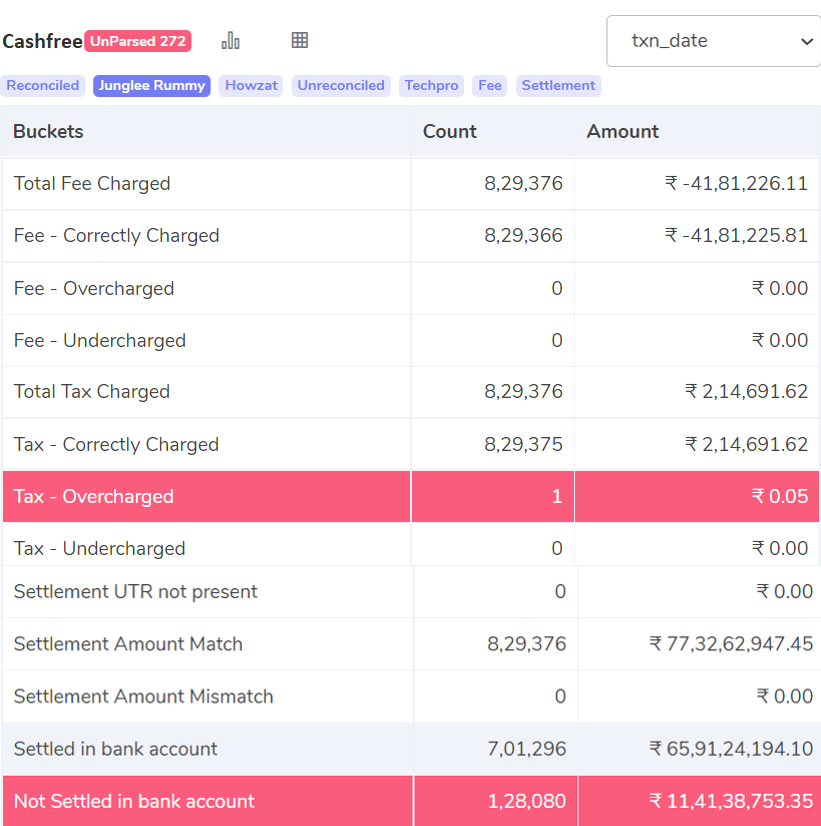

Cashfree Payment Gateway Charges Verification Result

Fee – Correctly Charged

The calculated fee is in line with what Cashfree charges. This implies that the fee associated with these orders was appropriately charged and is therefore reflected here.

Fee – Overcharged

The fee charged for these orders is more than the estimated fee. This indicates that the fee is excessively charged for these orders.

Fee – Undercharged

The cost charged for these orders is lower than the amount determined by the software. The fee is therefore indicated here because it is undercharged for these orders.

Tax – Correctly Charged

These are the orders where the tax amount levied by Cashfree and tax amount computed by the software match. The orders that the right tax amount is levied to are displayed in this bucket. The tax is applied to the fee at a GST rate of 18%.

Tax – Overcharged

On these orders the tax amount charged by Cashfree is more than the tax amount calculated by the software. The tax is charged as per 18% GST on fee.

Tax – Undercharged

These are the orders for which Cashfree charges less tax than the amount that the software calculates. This implies that the tax on these orders is not properly charged. The tax is applied to the fee at the GST rate of 18%.

Settlement Amount Match

Settlement Amount = Amount Collected from Customer – Fee Charge – Tax Charge

The settlement amount is determined using the provided formula. Transactions are shown here when the settlement amount reported in Cashfree matches the amount determined by the software.

Settlement Amount Mismatch

Our software displays the orders for which the settlement amount does not match the settlement amount recorded in the Cashfree report after using the aforementioned formula to calculate the settlement amount.

Settlement UTR not present

UTR is the transaction ID that banks use to identify transactions. The absence of the UTR for a transaction signifies that it was not completed. These orders are shown in this bucket by the software.

Settled in Bank Account

These are the transactions for which the final settlement amount recorded in Cashfree appears in the bank account.

Not Settled in Bank Account

As previously noted, the software uses the Cashfree report and the Bank statement to confirm the settled amount. It lists the orders for which the amount that must be settled in the bank is missing from the bank statement.

Our software result makes it simpler for company’s finance departments to analyze. The software also displays if any fees or taxes have been overcharged, which can help you prevent future losses. It also demonstrates whether the settlement sum is accurate and whether the total sum has actually been credited to your bank account. This will enable you to keep track of each payment made and, in the event of a less-than-expected payment, obtain the necessary amount from the bank or Cashfree.