Evaluating Xero reconciliation software alternatives? We have made this process easier for you by listing our top 5 picks for Xero reconciliation alternatives. With the help of this article, pick the software most suitable for your business.

Manually reconciling data is a difficult task for the finance team. When data is reconciled manually there is a possibility of human error and it takes too much time to complete the process. Hence many businesses are making the switch to automated reconciliation. With an automated reconciliation software, this complicated process is completed much more quickly.

When reconciliation is automated the software takes up this tedious process and completes it more accurately while saving time. It cleans the data automatically by applying logic conditions to produce the report. This ensures that all results are generated on time with complete efficiency.

Xero facilitates various financial services such as bill payments, reimbursements, claiming expenses etc. Since we are looking for reconciliation software let’s focus on Xero reconciliation. Its reconciliation tool specializes in bank reconciliation. It directly imports transactions from the bank account and reconciles with the Xero ledger to produce results. The results are easy to analyse with metrics and graphs displayed on the dashboard.

Other functions:

- Automated transaction matching

- Manage fixed assets and prepare plans

- Give Access to clients to view and reconcile data

- Integrate with other Xero tools such as cashbook, ledger, HQ etc

Xero is a software suitable for small to medium-sized businesses that they can complete reconciliation and accounting together with ease. In case Xero does not fit your requirements we have listed our top 5 alternatives to Xero below.

1. Cointab

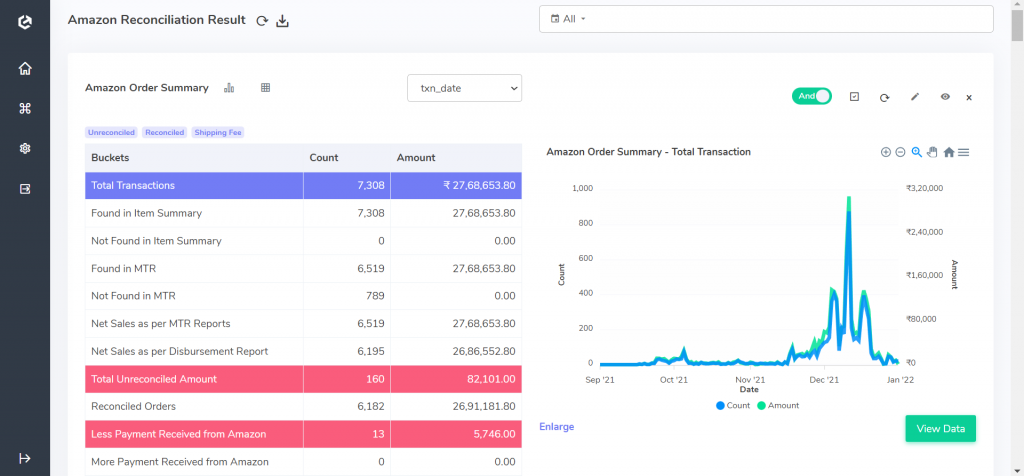

Cointab reconciliation helps maintain accuracy and efficiency in the reconciliation process. It simplifies the finance team’s work as it automates many manual tasks in reconciliation such as data loading. It automatically loads data while accepting any file format. It also has various other customisations available on the software such as a user can enter a custom rules engine so the conditions match their business rules. The software can scale along with the business’ growing needs. Hence even a large organisation can depend on the software as it is capable of handling a large amount of data. So once the file upload and linking is complete the software reconciles the transactions producing an easy to analyse reconciliation result. The results highlight the amount mismatches so that managers are able to track missing or extra paid items. Along with a summary view, the software also lets you view details of a particular transaction across all reports. In case the payments have to be manually settled the software also lets you add exceptions to transactions. The software lets you automate various reconciliation processes which include payment gateway reconciliation, COD remittance, bank reconciliation, OMS reconciliation, ERP reconciliation, Marketplace Reconciliation (Amazon, Flipkart, Myntra, Nykaa, Ajio, TataCliq and many more) and fee verification. So, Cointab reconciliation simplifies the reconciliation processes and saves the effort spent by the finance team.

2. Blackline: